Are you a proud new homeowner or aspiring to join the ranks soon? Congratulations! However, with the keys to your dream home comes the responsibility of managing your monthly Freedom Mortgage payments. Don’t worry, budgeting for your mortgage doesn’t have to be a daunting task. In this comprehensive guide, we’ll walk you through practical and straightforward tips on how to budget for your Freedom Mortgage monthly payment, ensuring that you stay on track financially while enjoying the comforts of your new abode. Say goodbye to mortgage stress and hello to financial freedom!

Determine monthly income and expenses.

Ready to conquer your Freedom Mortgage monthly payment like a boss? Start by figuring out your monthly income and expenses. Track every penny coming in and going out, so you can create an accurate budget. The more detailed, the better! This will set you up for success and make adulting a breeze.

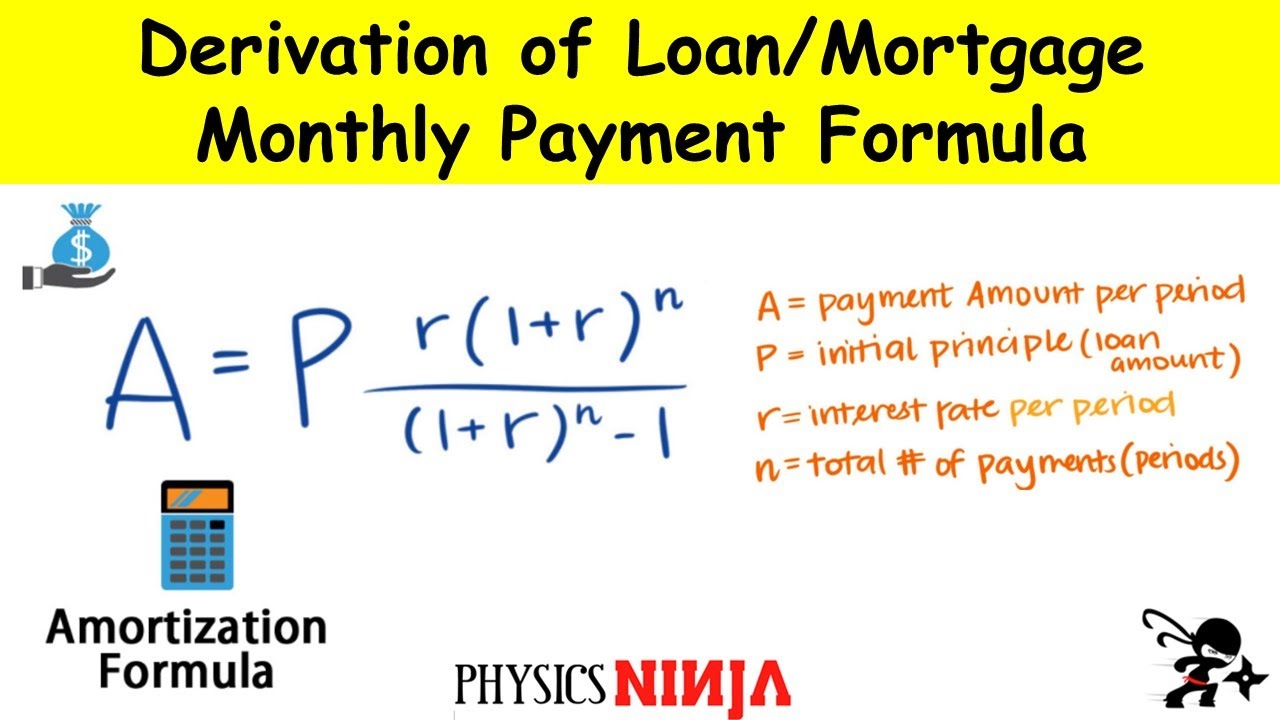

Calculate mortgage payment with calculator.

Ready to conquer your mortgage game? Start by calculating your monthly payment using a mortgage calculator! Simply plug in your loan amount, interest rate, and loan term to get an instant estimate. This nifty tool helps you stay on top of your budget, ensuring your dream home won’t turn into a financial nightmare. Stay savvy, future homeowner!

Allocate funds for additional costs.

Don’t forget to stash some cash for extra expenses, fam! Owning a crib comes with surprise costs like taxes, insurance, and maintenance. Plan ahead and keep your finances on fleek by setting aside a lil’ extra for these not-so-obvious bills. Stay woke about your budget and enjoy that sweet freedom mortgage life!

Prioritize essentials, cut unnecessary spending.

When budgeting for your Freedom Mortgage monthly payment, it’s crucial to prioritize essentials and trim down frivolous spending. Focus on covering necessities like rent, food, utilities, and your mortgage payment, while cutting back on non-essentials like eating out, subscriptions, and impulse buys. This way, you’ll ace your mortgage payments and adulting in general!

Create emergency fund for contingencies.

Building an emergency fund is a must when budgeting for your Freedom Mortgage monthly payment. Life is unpredictable, so having a financial safety net can save you from unexpected expenses, like home repairs or medical bills. Start by setting aside a small amount each month, and watch your rainy-day fund grow, providing you peace of mind and financial stability.

Review and adjust budget regularly.

Stay on top of your financial game by regularly reviewing and adjusting your budget. This ensures you’re prepared for any fluctuating expenses and helps maintain a stress-free mortgage payment experience. Keep track of your spending habits and make the necessary tweaks to live comfortably and confidently with your Freedom Mortgage payments.