Are you considering buying a home but worried about the costs associated with a mortgage? One cost you may not be aware of is mortgage insurance. Mortgage insurance is an extra cost that is added to your monthly mortgage payment and can be quite significant. In this article, we’ll explore exactly how much mortgage insurance costs and why it’s important for homebuyers to understand this cost.

What is Mortgage Insurance & How Does It Work?

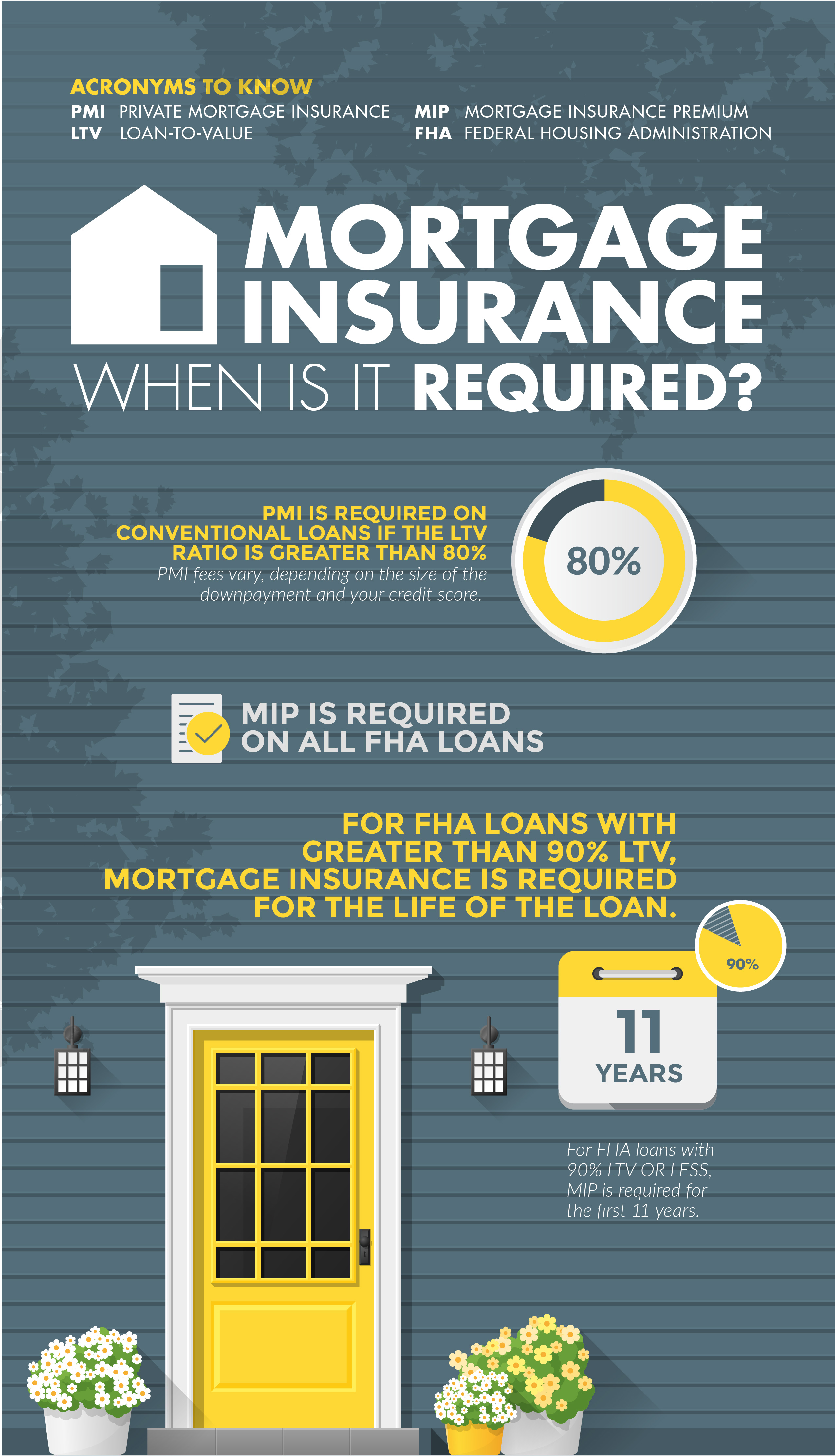

Mortgage insurance is an extra layer of protection for lenders that helps protect them from losses in the event that a borrower defaults on their mortgage loan. It’s an insurance policy that is usually paid by the borrower and is required by lenders when the borrower makes a down payment of less than 20% of the purchase price of the home. Mortgage insurance works by covering a portion of the loan balance in the event of a default. This helps to protect the lender from losses and allows them to offer borrowers lower down payment loans. Mortgage insurance can be an additional cost to borrowers, but it can also help make homeownership more affordable. Most lenders require mortgage insurance when a borrower makes a down payment of less than 20% of the purchase price, so it’s important to understand how mortgage insurance works and how it can affect your loan.

How Much Does Mortgage Insurance Cost?

Mortgage insurance is an important part of any mortgage, as it helps protect lenders in the event of a borrower defaulting on their loan. But just how much does mortgage insurance cost? It depends on a variety of factors, such as the loan-to-value ratio, your credit score, and the type of mortgage insurance you choose. Generally speaking, the higher your loan-to-value ratio and credit score, the lower the cost of your mortgage insurance. On the other hand, the cost of mortgage insurance can vary depending on the type of mortgage insurance you choose. Private mortgage insurance is typically the most expensive option, while government-backed mortgage insurance is typically the least expensive. Ultimately, the cost of mortgage insurance will depend on your individual situation, so it’s important to speak with a qualified mortgage professional to determine the best option for you.

Who Pays for Mortgage Insurance?

Mortgage insurance is one of those costs that can be confusing when it comes to buying a home. Who pays for it? Well, the answer to that depends on the type of loan you’re getting. If you’re getting a government-backed loan, then the government will typically pay for the mortgage insurance. FHA mortgage insurance is paid by the borrower and is an upfront cost, usually rolled into the loan amount, and an annual fee, paid for each year the loan is in place. VA loans don’t require mortgage insurance, so there’s no cost for the borrower. Conventional loans have mortgage insurance, but it’s paid by the lender and is typically rolled into the loan amount. So, overall, the answer to “who pays for mortgage insurance” will depend on the type of loan you’re getting. Make sure to ask your lender which type of loan is best for you and what the costs associated with it are.

Are There Alternatives to Mortgage Insurance?

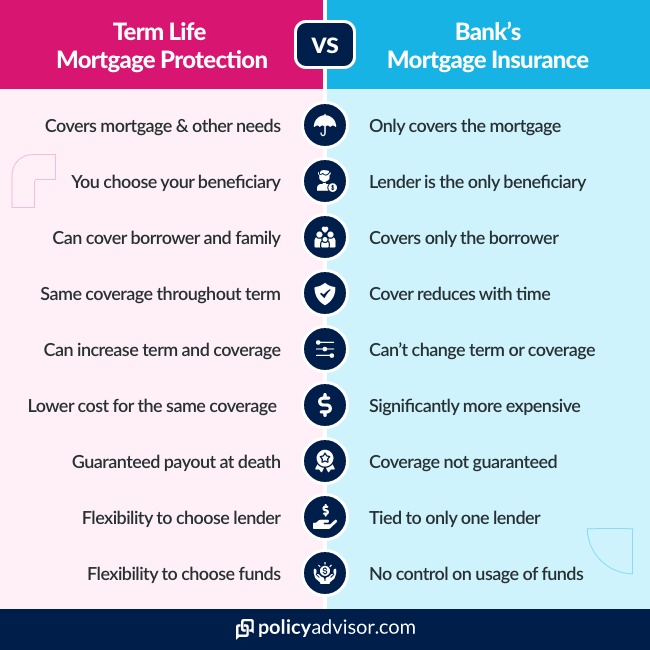

Mortgage insurance isn’t the only way to protect yourself against the risks associated with a mortgage. There are alternatives, such as taking out an unsecured loan, which can help you cover your mortgage payments if you experience financial difficulties. Another option is to purchase a mortgage protection policy, which will pay off the mortgage if you die or become disabled. Finally, some lenders offer mortgage guaranty insurance, which helps protect lenders against losses if the borrower defaults on the loan. While there are alternatives to mortgage insurance, they all come with their own risks and costs, so it’s important to research the different options and determine which one makes the most sense for your situation.

How Can I Reduce My Mortgage Insurance Costs?

If you’re looking to reduce the cost of your mortgage insurance, there are a few things you can do. First, you can apply for an FHA loan, which offers a lower rate than conventional loans. You can also look into private mortgage insurance (PMI) that may be available if you have a higher credit score. Additionally, you can pay a larger down payment and get a lower rate. Finally, you can shop around for different lenders to compare rates and find the best deal for you. By taking the time to research your options, you can save money on your mortgage insurance costs and make your home more affordable.