Are you considering taking out a mortgage but worried about the cost of mortgage insurance? You’re not alone, and it’s important to understand how much mortgage insurance costs so you can make an informed decision about your finances. In this article, we’ll discuss the different types of mortgage insurance, how much it usually costs, and how to reduce the amount you pay. Read on to learn more about mortgage insurance and how it affects your bottom line.

What Is Mortgage Insurance and How Does It Work?

Mortgage insurance is a type of insurance that protects lenders in the event that a borrower defaults on their mortgage loan. It protects the lender from having to bear the full losses of a borrower’s default and helps to ensure that the lender is able to recoup the costs of the loan. Mortgage insurance is paid by the borrower and is usually included in the monthly mortgage payments. It typically covers a portion of the loan amount and is usually equivalent to between 0.3 and 1.5% of the loan amount. Mortgage insurance can be a great way to reduce the risk of default and can help borrowers get approved for a loan. It is important to understand how mortgage insurance works and to consider the costs associated with it before signing a loan agreement.

How Much Does Mortgage Insurance Cost?

Mortgage insurance can be an expensive expenditure, but it doesn’t have to be. Understanding how much mortgage insurance costs can help you budget more accurately and make sure you’re getting the best deal possible. The cost of mortgage insurance will vary depending on the type of loan you’re taking out, the amount of the loan, and the lender you’re using. Generally, the more money you borrow, the more you’ll have to pay in mortgage insurance, but there may be other factors that can affect the cost as well. Shopping around and comparing quotes can help you find the most cost-effective option for your needs.

Different Types of Mortgage Insurance

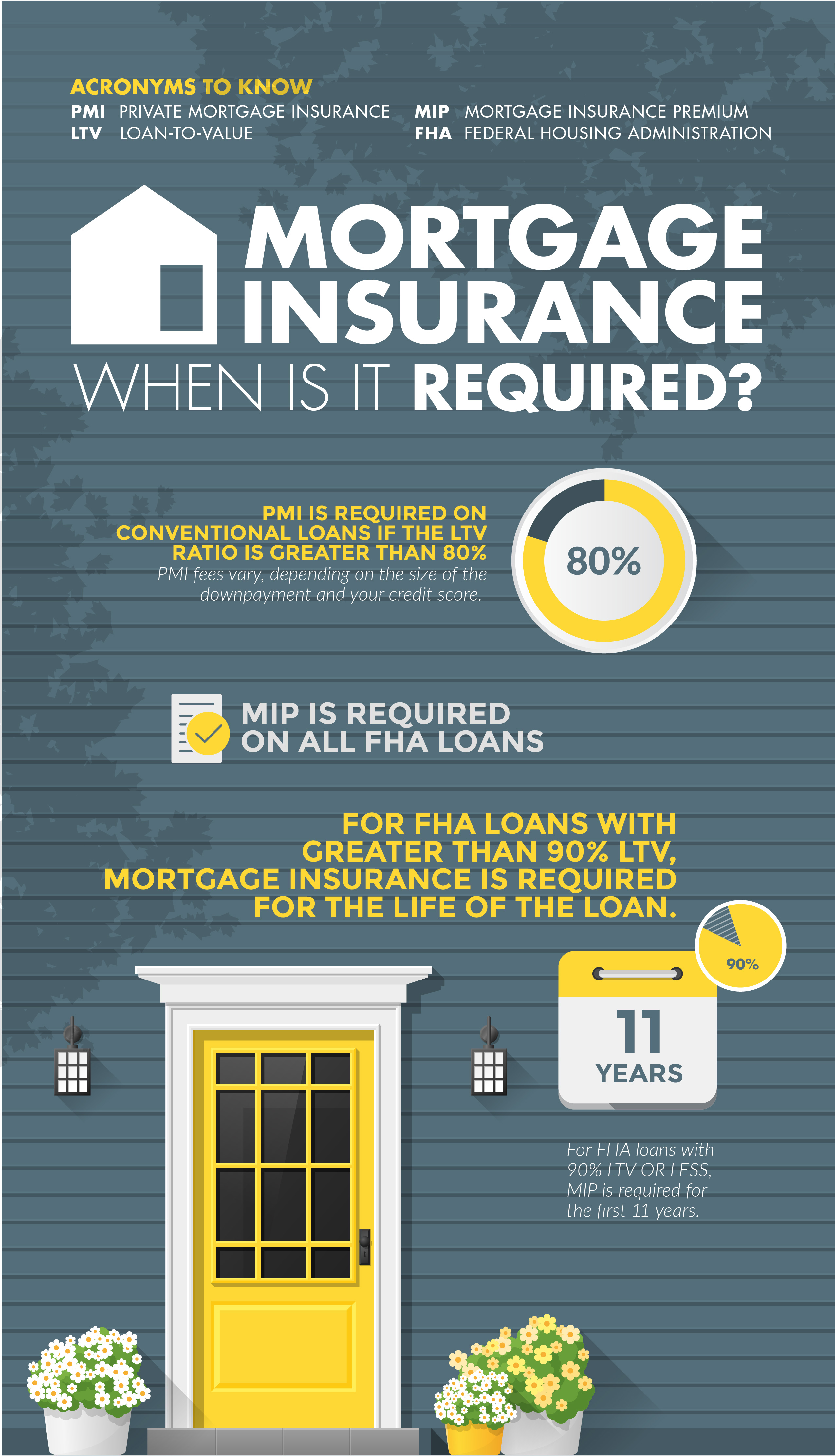

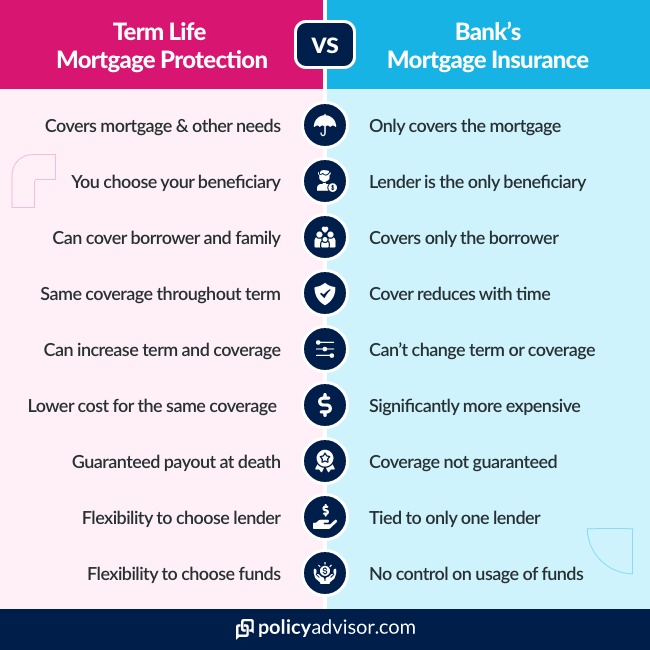

Mortgage insurance is an important part of securing a home loan, but it can be confusing to understand the different types and how much you should pay. PMI, or private mortgage insurance, is a type of insurance that protects lenders in the event that a borrower defaults on their loan. It is typically required for borrowers who put down less than 20% of the total home purchase price as a down payment. Another type of mortgage insurance is MIP, or mortgage insurance premium, which is required for FHA loans. MIP can be paid either upfront or in monthly installments and is usually 0.5-1% of the total loan amount. Lastly, there is lender-paid mortgage insurance, which is insurance paid for by the lender and added to the loan amount. This type of insurance is usually the most expensive, but it does come with a number of advantages, such as lower closing costs and a lower monthly payment. No matter which type of mortgage insurance you decide to go with, understanding the various options can help you make an informed decision.

Pros and Cons of Mortgage Insurance

Mortgage insurance can be a great way to protect yourself from defaulting on your loan. It can give you peace of mind that you won’t lose your home if you can’t make your payments. But it doesn’t come without its drawbacks. Let’s take a look at the pros and cons of mortgage insurance so you can decide if it is right for you. The biggest pro to mortgage insurance is that it can protect you if you can’t make your payments. If you were to default on your loan, the insurance would cover the lender’s losses. This can be a huge relief if you’re facing financial hardship and don’t want to risk losing your home.On the other hand, the cost of mortgage insurance can be a major downside. In many cases, you’ll have to pay a premium up front, as well as an ongoing monthly cost. This can add substantially to the cost of your loan, making it much more expensive in the long run. Additionally, you won’t be able to get a refund of the premium if you decide to cancel your policy.Ultimately, mortgage insurance can be a great way to protect yourself

Ways to Avoid Mortgage Insurance

Mortgage insurance is an added expense that can really drive up the cost of buying a home. But there are ways to avoid it. One way is to put down a larger down payment. Generally, if you can put down 20% of your home’s purchase price, you won’t have to worry about mortgage insurance. It’s also important to keep your debt-to-income ratio in check. If you can keep your debt-to-income ratio below 43%, you may be able to avoid mortgage insurance. Finally, it’s always a good idea to check with your lender to see if they offer specialized loan programs that do not require mortgage insurance. Taking the time to explore these options can help you save money in the long run.