Are you thinking of buying a home, but don’t know where to start? FHA mortgages may be the answer for you. FHA mortgages provide a more accessible loan option for potential homeowners, offering lower down payments, competitive interest rates, and lenient credit requirements. This guide will provide you with the information you need to understand what an FHA mortgage is, the eligibility requirements, and how to get started in applying for one.

What is an FHA Mortgage?

An FHA mortgage is a type of loan you can use to buy a home. It is insured by the Federal Housing Administration (FHA), which is part of the U.S. Department of Housing and Urban Development (HUD). The FHA doesn’t actually lend you the money for the loan, but instead insures the loan, meaning if you default on the loan, the FHA will cover the lender’s losses. This makes it easier for people with lower incomes and/or lower credit scores to get approved for a mortgage, since the FHA is taking on some of the risk. With an FHA mortgage, you can get into a home with a smaller down payment and a more flexible credit score requirement. Plus, you can take advantage of lower interest rates, making your monthly payments more affordable. All in all, an FHA mortgage is a great way to get into the home of your dreams.

Requirements for Qualifying for an FHA Mortgage

So, you’re thinking about getting an FHA mortgage, but you’re not sure if you qualify? Don’t worry – qualifying for an FHA mortgage can be a lot easier than you think. The key is understanding what requirements you need to meet in order to get approved. Generally, you’ll need to provide proof of income and have a credit score of at least 580. You’ll also need to have a down payment of at least 3.5% of the loan amount. Additionally, you’ll need to make sure that you have enough money in the bank to cover the closing costs. Finally, you’ll need to be able to show that you have a stable employment and residence history. With all these requirements in mind, you should have no trouble qualifying for an FHA mortgage and getting the home of your dreams!

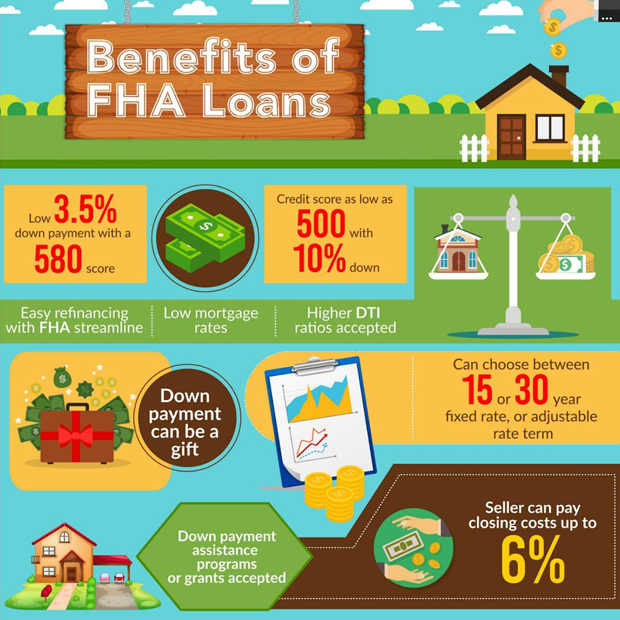

Benefits of an FHA Mortgage

If you’re looking to buy a home, an FHA mortgage might be the perfect way to go. An FHA mortgage comes with a bunch of awesome benefits that can make it easier for you to get into a home. With an FHA mortgage, you’ll get lower down payments, more lenient credit standards, and more flexible underwriting criteria. Plus, you can get your mortgage insured by the government, so you don’t have to worry about taking on too much risk. You’ll also get access to closing cost assistance, allowing you to save money when you buy a home. And, of course, you’ll have access to more low-interest rate loans, so you can buy your dream home without breaking the bank. With all these great benefits, it’s no wonder FHA mortgages are becoming so popular.

How to Avoid Plagiarism in Your FHA Mortgage Application

When it comes to avoiding plagiarism in your FHA mortgage application, the best way to go about it is to make sure you’re writing everything in your own words. It can be easy to get caught up in research and copy chunks of text without realizing it, but it’s important to remember that plagiarism is a serious offense that can have serious consequences. So if you’re writing an FHA mortgage application, make sure you’re doing your own work and not copying someone else’s. Even if you’re using another person’s information, make sure to cite it properly and never copy it word-for-word. Don’t risk getting caught up in a plagiarism scandal; make sure you’re taking the time to do your own work and write everything in your own words.

Tips for Choosing the Right FHA Mortgage Lender

Choosing the right FHA mortgage lender can be overwhelming – there are so many options available! To make the process easier, here are some tips to keep in mind. First, consider the reputation of the lender – read reviews online to see what others have to say about their experience with them. Second, look for a lender that offers competitive rates and fees. Third, make sure the lender has experience working with FHA loans – you want someone who knows the ins and outs. Finally, make sure the lender is willing to work with you to find the best loan for your situation – don’t choose one that won’t listen to your needs. With these tips in mind, you’ll be on your way to finding the perfect FHA mortgage lender for you.