Are you considering an FHA loan but are worried about your bad credit? You’re not alone. Many potential homeowners worry that their credit score and history could keep them from obtaining a loan, but with an FHA loan, it’s possible to get the financing needed to purchase a home, even with a low credit score. With flexible credit requirements, competitive interest rates and low down payment options, an FHA loan is a great option for people with bad credit. In this article, we’ll discuss the benefits of an FHA loan for bad credit, and how you can qualify for one.

What is an FHA Loan?

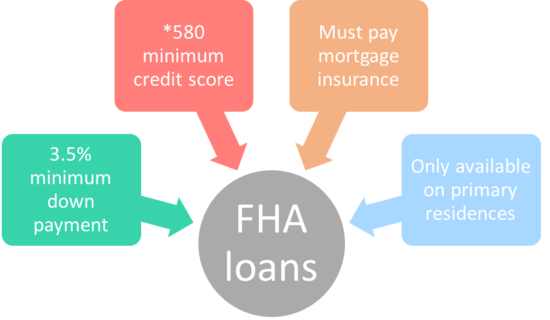

An FHA loan is one of the most popular loan options out there for people with bad credit. FHA loans are backed by the Federal Housing Administration, meaning they are insured by the government and have less stringent eligibility requirements to qualify for than conventional loans. With an FHA loan, you can get a loan with a down payment as low as 3.5%, even with a credit score as low as 580. This makes them a great option for people who are looking to buy a home but don’t have the ideal credit score. Plus, FHA loans have lower interest rates than conventional loans and can be easier to get approved for. So if you’re looking for a loan and have bad credit, an FHA loan may be the perfect solution.

How FHA Loans Can Help People with Bad Credit

FHA loans are a great option for people with bad credit who need to buy a home. With FHA loans, you can get lower interest rates than traditional loans, which can make it easier to afford a mortgage. Plus, the down payment required is much lower than with other loan types. This makes it easier to get into a home without having to save up a large down payment. FHA loans also don’t require perfect credit, so people with bad credit can still qualify. FHA loans are a great way to get into a home and start building equity, no matter your credit score.

Qualifying for an FHA Loan with Bad Credit

.If you have bad credit, you might think that getting an FHA loan is out of reach. But don’t worry! Even if you have bad credit, you can still qualify for an FHA loan. This type of loan is backed by the Federal Housing Authority, and it’s designed to help people with lower credit scores get the funds they need for a home purchase. To qualify, you will need to show that you have a steady income, an acceptable debt-to-income ratio, and a history of on-time payments. You may also need to show that you have a history of saving money, and that you have a plan to pay off your loan. With an FHA loan, you can get the home you want and start building a better credit score.

Understanding the Benefits of FHA Loans for Bad Credit

FHA loans are a great option for people with bad credit. Not only are these loans easier to qualify for than traditional loans, but they also offer some great benefits. The most obvious benefit of an FHA loan for someone with bad credit is the fact that you don’t need a large down payment or a high credit score to be approved. Additionally, the fact that FHA loans are insured by the government makes them a safer option for lenders. This means that even if your credit score is low, you can still get a loan. Furthermore, FHA loan rates tend to be lower than those of other types of loans, which means that you can save money on your monthly payment. With all these benefits, it’s no wonder why FHA loans are becoming increasingly popular for people with bad credit.

Tips for Successfully Applying for an FHA Loan with Bad Credit

Applying for an FHA loan with bad credit can be a nerve-wracking experience, but it doesn’t have to be! With the right tips and advice, you can make the process go much smoother. First and foremost, research your credit score and understand what you’re working with. Knowing your credit score is the first step in figuring out the best way to approach an FHA loan with bad credit. Secondly, work on improving your credit score by addressing any outstanding debt, making timely payments, and reducing your debt-to-income ratio. Finally, it’s important to shop around and compare lenders to make sure you’re getting the best rate. With a bit of diligence and preparation, you can successfully apply for an FHA loan with bad credit.