Are you drowning in student loan debt and seeking a lifeline through loan forgiveness? You’re not alone! However, navigating the complex world of student loan forgiveness can be daunting, and many borrowers unwittingly make costly errors in the process. In this comprehensive guide, we’ll explore the most common mistakes to avoid when applying for student loan forgiveness, ensuring you stay on the right path to financial freedom. Don’t let misinformation or missteps hinder your chances of success; let us help you demystify the loan forgiveness process and make it work for you!

Navigating the Complex World of Student Loan Forgiveness Programs: Top Pitfalls to Steer Clear Of

Navigating the intricate landscape of student loan forgiveness programs can be a daunting task, with numerous pitfalls to avoid for a successful application. Failure to adhere to specific requirements or missing crucial deadlines can significantly hinder your chances of approval. In this blog post, we’ll explore the top pitfalls to steer clear of, such as not understanding your loan type, neglecting to enroll in the right repayment plan, overlooking employment qualifications, and failing to submit accurate, timely documentation. By being vigilant in avoiding these common mistakes, you’ll be well on your way to securing the financial relief you need through student loan forgiveness programs.

Don’t Let These Common Errors Derail Your Student Loan Forgiveness Application: Expert Tips and Solutions

Avoiding common errors is crucial for a successful student loan forgiveness application. To ensure a seamless process, stay informed about the requirements and deadlines associated with your specific forgiveness program. Be diligent in maintaining accurate records of your employment, loan payments, and qualifying service hours. Regularly update your loan servicer with any changes to your personal information, employment, or repayment plan. Seek assistance from a financial advisor or student loan expert to help navigate the complexities of the application process. By staying proactive and well-informed, you can minimize the chances of encountering roadblocks and maximize your eligibility for student loan forgiveness.

Unraveling the Misconceptions: Crucial Dos and Don’ts for a Successful Student Loan Forgiveness Application

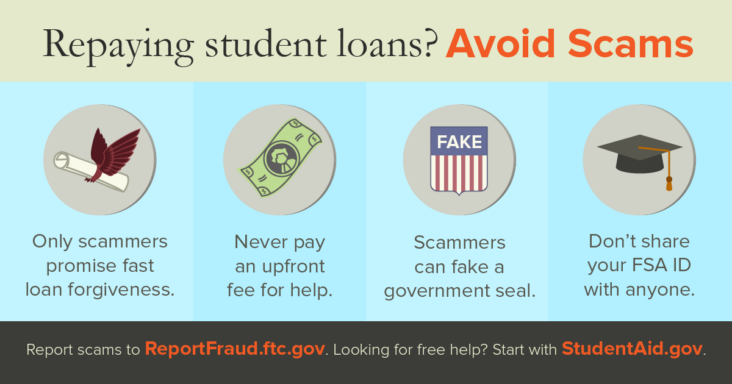

Unraveling the misconceptions surrounding student loan forgiveness is essential for a successful application. One crucial aspect to consider is the eligibility of your loans; only federal loans qualify for forgiveness programs. Additionally, ensure you’re enrolled in the right repayment plan, such as Income-Driven Repayment (IDR), to maximize your potential forgiveness benefits. Don’t overlook the importance of submitting accurate and timely paperwork, as errors can lead to delays or disqualification. By understanding the dos and don’ts of student loan forgiveness, you’ll be better prepared to navigate the process and avoid common pitfalls that could hinder your financial future.

A Roadmap to Student Loan Forgiveness: Essential Guidelines to Bypass Common Application Blunders

Navigating the path to student loan forgiveness can be a daunting task, filled with potential missteps and costly errors. To secure the financial relief you deserve, it’s crucial to follow a well-defined roadmap that highlights essential guidelines to bypass common application blunders. As you embark on this journey, be sure to carefully research the different forgiveness programs, understand the eligibility requirements, and maintain accurate documentation throughout the process. By staying organized, diligent, and proactive in your approach to student loan forgiveness, you’ll maximize your chances of a successful application and a brighter financial future.

Unlock the Door to Student Loan Forgiveness: Smart Strategies to Avert Common Application Mistakes and Maximize Approval Chances

Unlock the door to student loan forgiveness by implementing smart strategies and sidestepping common application mistakes. Maximize your approval chances by ensuring accurate information, adhering to deadlines, and selecting the appropriate forgiveness program. Don’t forget to verify your eligibility criteria, maintain thorough documentation, and enroll in qualifying repayment plans. Stay informed about the latest changes and updates in student loan forgiveness policies. By steering clear of these pitfalls and keeping a proactive approach, you can enhance your prospects of securing a debt-free future and making the most of the opportunities student loan forgiveness programs provide.