Are you looking for the best mortgage interest rates banks in India? You’ve come to the right place! This guide provides an in-depth comparison of the best banks offering mortgage interest rates in India. We have researched the market and identified the top banks with the best rates, terms, and conditions. We have considered factors like customer service, flexible repayment options, and other advantages to provide you with the best selection of banks for your mortgage needs.

ICICI Bank: ICICI Bank offers one of the best mortgage loan interest rates in India, starting at 6.90%

When looking for a great mortgage loan interest rate, ICICI Bank is definitely the way to go. They offer rates as low as 6.90%, making it one of the best options in India. Not only that, but they provide a variety of other services such as easy documentation, speedy loan approval and flexible loan repayment options. With ICICI Bank, you can rest easy knowing you’re getting the best possible mortgage loan interest rate and all the other perks that come with it. So what are you waiting for? Get your mortgage loan with ICICI Bank and get the best deal today!

This bank offers both floating and fixed rate loans and provides a loan amount of up to Rs

Getting the best mortgage interest rate in India is something that all homebuyers should strive for. Thankfully, there are plenty of banks in India that offer competitive rates on both floating and fixed rate loans. Whether you’re looking to buy your first home, refinance your current mortgage or take out a consolidation loan, you can be sure you’re getting the best deal out there. One of the best banks in India for mortgage interest rates is [Name of Bank]. It offers loan amounts of up to Rs. [amount], and the interest rate is highly competitive. If you’re looking for a great deal on your home loan, [Name of Bank] is definitely worth checking out. Not only do they offer the best mortgage interest rates in India, but their customer service is top notch. Plus, they have a wide range of loan options to choose from, so you’re certain to find the perfect one for you. With [Name of Bank], you can rest assured that you’re getting a great deal on your mortgage.

5 Crores.

If you’re looking for the best mortgage interest rates for loans of up to 5 Crores, then you need to shop around to find the right lender for your needs. India is home to some of the top banks in the world, and they all offer competitive mortgage rates that can suit your needs. However, it’s important to compare different banks and their offerings to make sure you’re getting the best deal. Look for banks that offer flexible repayment options, low interest rates, and competitive fees. Make sure to ask about any additional fees or charges that may be associated with the loan. With the right research and comparison, you can find the best mortgage interest rates for loans of up to 5 Crores in India.

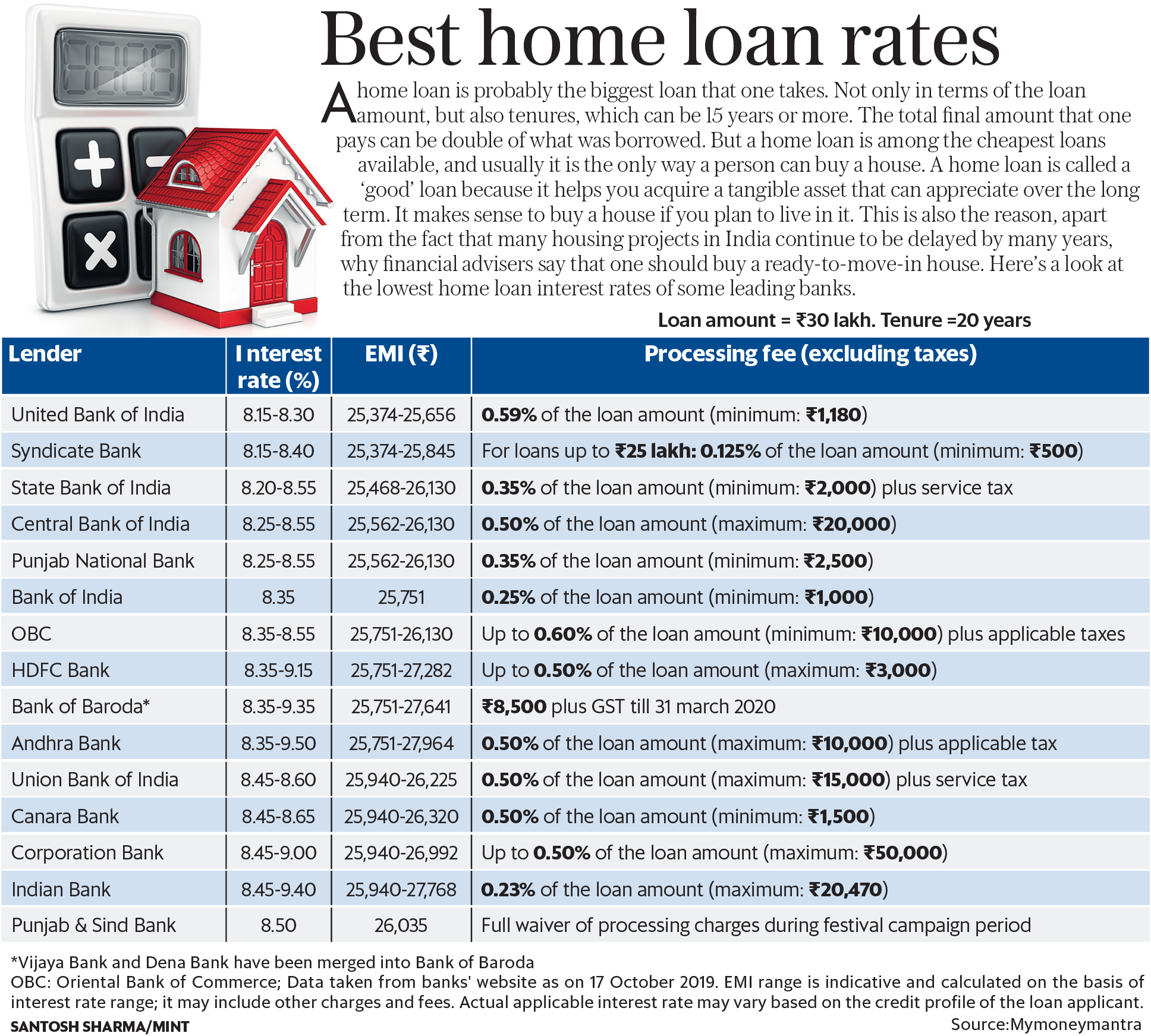

HDFC Bank: HDFC Bank offers one of the lowest home loan interest rates in India, starting at 6.85%

HDFC Bank is the ideal choice for anyone looking for the best mortgage interest rates in India. Not only does it offer one of the lowest home loan interest rates in the country, starting at 6.85%, but it also offers a variety of other benefits, like flexible repayment options and a wide range of loan amounts. Plus, the customer service provided by HDFC Bank is top-notch, making it easy to get the help you need when you need it. So if you’re looking for the best mortgage interest rates in India, HDFC Bank is the perfect choice!

They offer both floating as well as fixed rate loans and provide a loan amount of up to Rs

When it comes to finding the best mortgage interest rates in India, you won’t have to look any further than the banks. They offer both floating and fixed rate loans, with loan amounts up to Rs. So, no matter the type of loan you are looking for, the banks have you covered. Plus, with competitive interest rates, you can save thousands of rupees on your mortgage. So, if you’re looking for the best mortgage interest rates in India, look no further than the banks. They have the right loan for you, at the best possible rate.

10 Crores.

When it comes to getting a mortgage, it’s important to compare the best mortgage interest rates banks in India have to offer. With so many banks available, it can be hard to find the right one that suits your budget and needs. Luckily, 10 Crores has made it easy to find the best mortgage interest rates banks in India can offer. With a simple search, you can compare the different mortgage interest rates banks have and find the best one for you. With low interest rates and flexible payment plans, 10 Crores has the best mortgage interest rates banks in India can provide. So if you’re looking for a loan, make sure to check out 10 Crores and get the best deal on your mortgage.

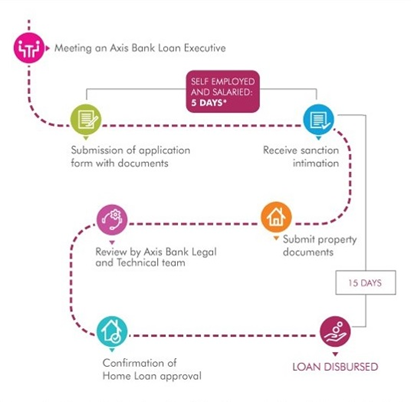

Axis Bank: Axis Bank offers one of the most competitive mortgage loan interest rates in India, starting at 6.90%

.Axis Bank is one of the leading banks in India when it comes to mortgage loan interest rates. They offer some of the most competitive rates out there, starting at 6.90%. Not only do they have great rates, but they also have a wide range of products to help you find the one that suits you best. They also have a great customer service team to help you with any queries you may have. With Axis Bank, you can be sure that you are getting the best mortgage loan interest rate possible.

This bank offers both fixed and floating rate loans and provides a loan amount of

If you’re in the market for a new mortgage, you’ll want to consider the best mortgage interest rates banks in India have to offer. From fixed-rate loans to floating-rate loans, there’s something for everyone. Plus, banks in India provide loan amounts of up to 85% of the property’s value, so you won’t have to worry about coming up short! With so many options out there, it can be tricky to figure out which bank offers the best rates. To make sure you get the most bang for your buck, be sure to compare rates and terms from a variety of banks in India. That way you can rest assured you’re getting the best mortgage rate possible.