A balloon mortgage is a type of loan that can be extremely beneficial for homeowners who need a long-term loan but want to pay it off sooner than a traditional mortgage. It’s important to understand the complexities of a balloon mortgage before taking one out, so this full guide will explain the different aspects of a balloon mortgage, the pros and cons, and more. With this comprehensive guide, you’ll be able to make an educated decision on whether a balloon mortgage is right for you.

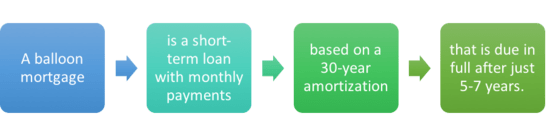

What is a Balloon Mortgage?

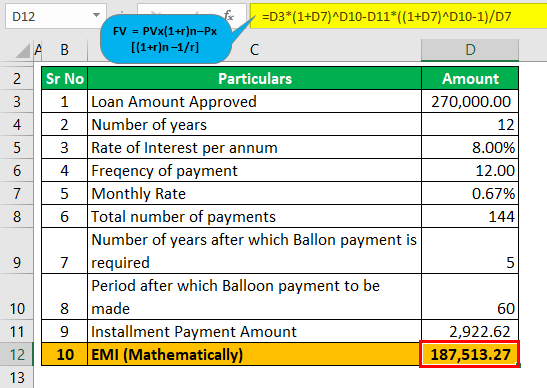

A balloon mortgage is a type of home loan that requires you to make a large lump sum payment at the end of the loan term. This type of loan is unique because it has a shorter term than a traditional mortgage, usually five to seven years. With a balloon mortgage, you make smaller payments over the course of the loan term, but you are required to pay off the entire loan amount at the end of the term. This can be a great option for someone who needs a short-term loan and has the means to pay off the loan in a lump sum at the end of the term. It can also be a great option for someone who is planning to refinance their loan or sell their home before the end of the term. Balloon mortgages can be a great way to get the home you want without having to commit to a long-term loan.

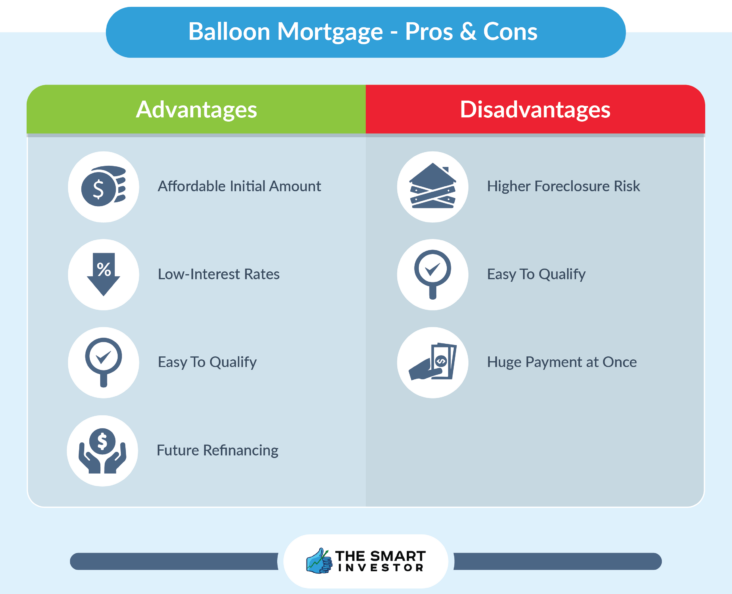

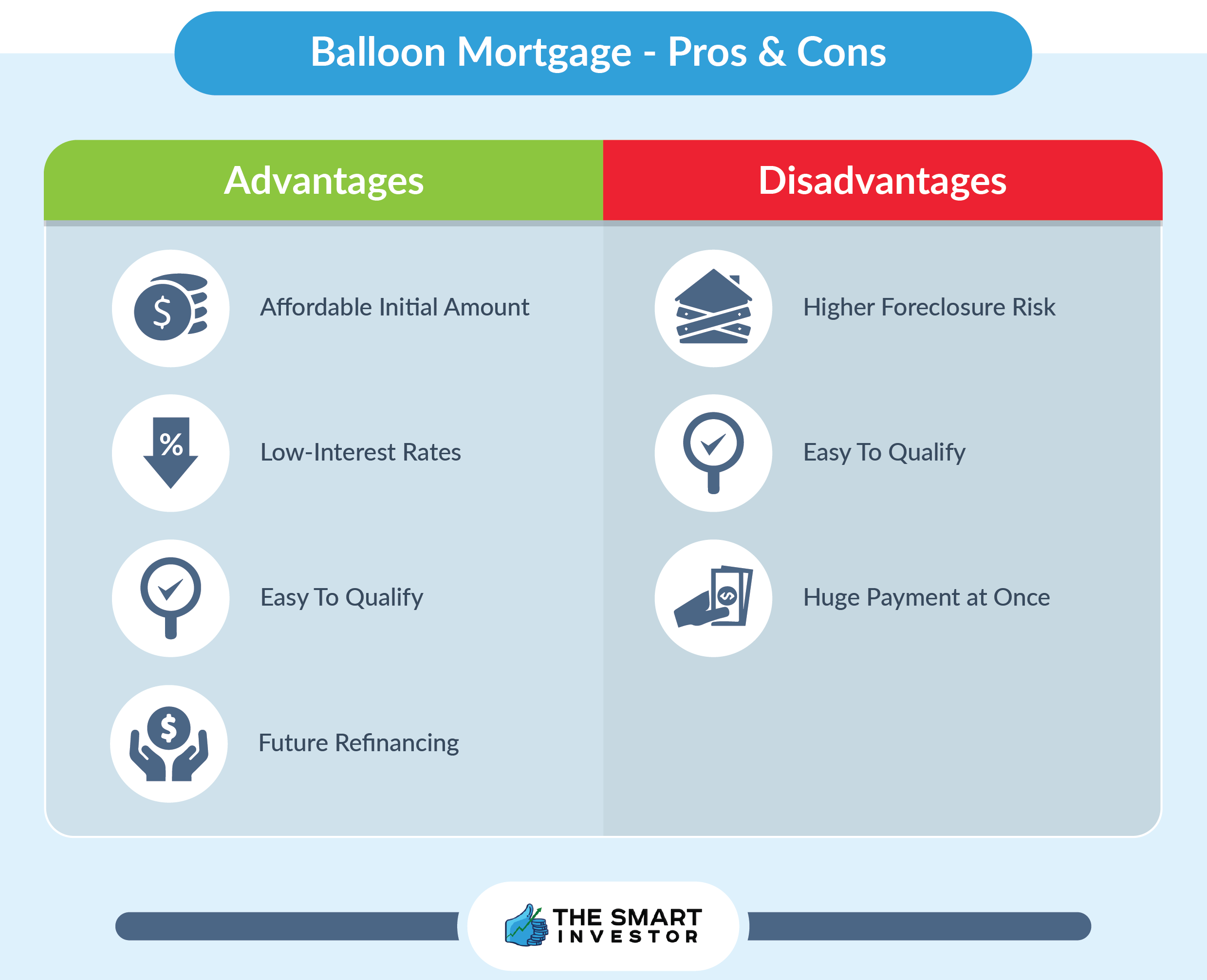

Advantages and Disadvantages of a Balloon Mortgage

A balloon mortgage is a great option for those looking to save on their monthly mortgage payments. With this type of mortgage, you pay lower payments over a certain period of time, but then you must pay off the entire loan balance in one lump sum at the end of the loan’s term. There are both advantages and disadvantages to a balloon mortgage that you should consider before making a decision.The main advantage of a balloon mortgage is lower monthly payments. You can save money in the short-term by paying smaller monthly payments, but you must be prepared to pay off the entire balance at the end of the loan’s term. This type of mortgage is also suitable for those who are planning to move out of the property in a few years and can pay off the balance of the loan before the balloon payment is due.On the downside, a balloon mortgage can be a risky option if you are not sure you will be able to pay off the loan at the end of the term. If you are unable to make the balloon payment, you may be forced to take out a more costly loan in order to pay off the balance. Additionally, some lenders may require you to purchase mortgage insurance to cover the loan in case you default.

When is a Balloon Mortgage a Good Idea?

If you’re considering a balloon mortgage, you might be wondering if it’s a good idea for you. Generally speaking, balloon mortgages are most beneficial for those who don’t plan on staying in a property for more than a few years. The low monthly payments allow you to save more money while you’re in the home, but you’ll have to pay off the remaining balance when the term is up. Another situation in which a balloon mortgage might be a good idea is if you’re looking to maximize your short-term cash flow. Low monthly payments combined with an eventual lump sum payout can be a great way to finance a big project. However, it’s important to remember that you’ll need to come up with the full amount when the loan term ends, so make sure you plan for that ahead of time.

How to Qualify for a Balloon Mortgage

Getting a balloon mortgage can be a great way to save money on your mortgage, but it’s important to make sure you qualify. To qualify for a balloon mortgage, you’ll need a good credit score, a reliable income, and enough assets to cover the payments. A lender will also want to make sure you have enough equity in your home to cover the balloon payment when it comes due. The lender will also look at your debt-to-income ratio to make sure you’re able to handle the mortgage payments each month. It’s important to remember, though, that with a balloon mortgage you will have a larger payment due at the end of the loan term. Make sure you are prepared for this before applying for a balloon mortgage.

Tips for Avoiding Plagiarism When Writing About a Balloon Mortgage

When writing about a balloon mortgage, it’s important to stay away from plagiarism and make sure that you’re writing in your own words. Plagiarizing can have serious consequences and it’s not something that you want to risk. To make sure that you’re avoiding plagiarism, cite any sources that you use, take notes while you’re researching, and rewrite any information that you find in your own words. Additionally, you can use tools like Grammarly and Copyscape to help you double check that your content is original and unique. Following these steps can help you make sure that you’re writing content that is your own and that you can be proud of!