Are you drowning in debt and desperately seeking a lifeline? Look no further! Our comprehensive guide to debt relief programs and options is here to rescue you from the depths of financial despair. Say goodbye to sleepless nights and hello to a brighter financial future as we unveil the secrets to regaining control of your finances. Dive into our expert advice on debt consolidation, debt settlement, credit counseling, and more – all designed to help you conquer your debt and achieve financial freedom. Don’t let debt weigh you down any longer; start your journey to financial recovery today with our all-inclusive guide to debt relief options!

Research various debt relief options.

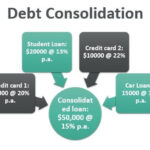

Dive deep into the world of debt relief options by exploring various alternatives tailored to your financial situation. Compare debt settlement, credit counseling, debt consolidation, and bankruptcy to find your perfect match. Boost your financial literacy, make informed decisions, and regain your freedom from debt with confidence.

Analyze personal financial situation.

Dive into your finances and take a good, hard look at your current money sitch. Understand where your cash is flowing and pinpoint those pesky debts. By analyzing your personal financial situation, you’ll be able to identify the ideal debt relief program that suits your needs. Level up your financial game, peeps!

Compare reputable debt relief providers.

Discover the top debt relief providers by comparing their services and success rates in our comprehensive guide. Our in-depth analysis of reputable companies ensures you’ll find the perfect solution for your financial situation. Say goodbye to overwhelming debt and hello to financial freedom with our expert recommendations tailored for today’s savvy 21-year-olds.

Choose suitable debt relief program.

Selecting the right debt relief program is crucial in regaining financial stability. With numerous options available, it’s essential to evaluate each program’s pros and cons. Carefully consider factors like repayment terms, interest rates, and eligibility requirements to determine the most suitable solution for your unique financial situation.

Understand program terms and fees.

Dive deep into the nitty-gritty of debt relief programs by thoroughly examining their terms and fees. Don’t let hidden charges or unfavorable conditions catch you off-guard! Educate yourself to make well-informed decisions and confidently navigate your path to financial freedom. Knowledge is power, after all!

Monitor progress and adjust if needed.

Keep a close eye on your debt relief journey! Regularly monitoring your progress helps you stay on track and make necessary adjustments. Don’t be afraid to tweak your strategies for better results, because staying flexible is the key to smashing those debt goals! Remember, you got this!