A commercial mortgage is a key component of any successful business. Whether you’re looking to start a business or expand an existing one, a commercial mortgage is an important tool for financing. This guide will provide you with the information and advice you need to confidently apply for and secure a commercial mortgage. From understanding the various types of commercial mortgages to exploring repayment options, you’ll find everything you need to know to make an informed decision. With this comprehensive guide, you’ll be well-prepared to secure the right mortgage for your business needs.

What is a Commercial Mortgage?

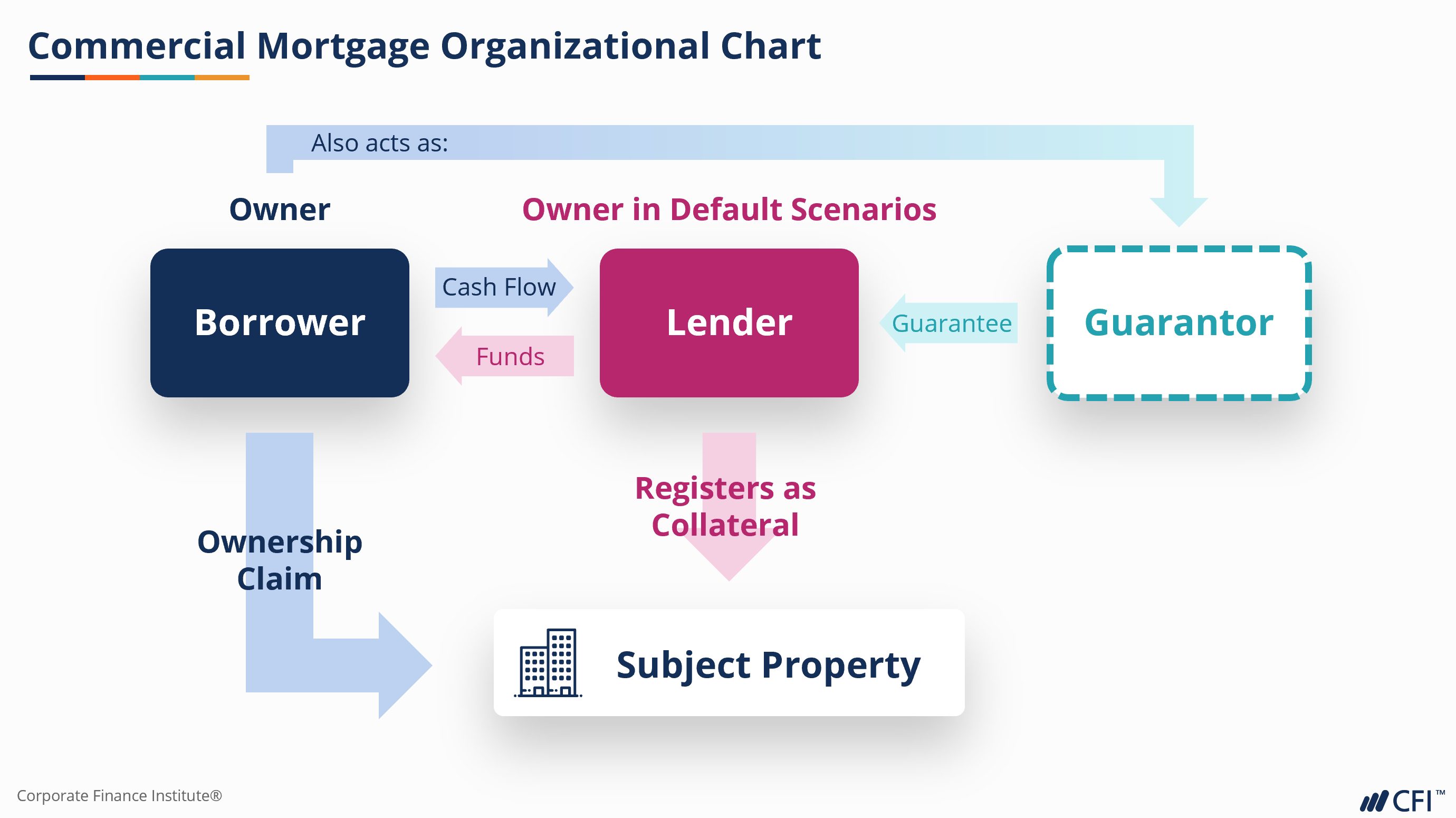

A commercial mortgage is a loan for businesses that need money to purchase, renovate, or refinance commercial property. This type of loan is typically used by businesses to purchase real estate, such as office buildings, warehouses, retail space, and/or multi-family residential buildings. A commercial mortgage is secured by the property that is being purchased or refinanced and is usually paid back over a period of several years. Commercial mortgages usually have higher interest rates and require larger down payments than residential mortgages, but they are also more flexible and offer more options for businesses. Commercial mortgages can be used to finance the purchase of land and buildings, as well as for construction projects, renovations, and refinancing existing mortgages.

Types of Commercial Mortgages

Commercial mortgages come in all shapes and sizes, and it can be difficult to know which one is right for you. With so many options out there, it’s important to understand what types of commercial mortgages are available so you can find the one that best fits your needs. The most common types of commercial mortgages include traditional mortgages, bridge loans, and portfolio loans. Traditional mortgages offer the most common terms and are typically the most affordable option, while bridge loans provide short-term financing that can help you bridge the gap between buying a property and securing long-term financing. Portfolio loans are a more specialized form of financing that can be used to purchase larger commercial properties. These loans are typically more expensive than traditional mortgages, but they can be a great option for businesses that need more capital. No matter what type of commercial mortgage you’re looking for, it’s important to do your research and find the one that best suits your needs.

Qualifying for a Commercial Mortgage

Qualifying for a commercial mortgage can seem like a daunting task in the face of all the paperwork and scrutiny, but with the right guidance, you can make the process a breeze. Taking the time to understand what lenders are looking for and having a good understanding of your business’ financials is key to getting approved for a loan. Lenders will typically assess your credit score and history, financial statements, and operating history to determine if you’re eligible for a loan. Additionally, they’ll want to know about the property you’re looking to purchase or refinance and make sure it’s worth the money you’re asking for. With a bit of preparation, you can make the process of qualifying for a commercial mortgage a lot easier and get the capital you need to grow your business.

Documents Required for a Commercial Mortgage

When applying for a commercial mortgage, it’s important to have all the required documents ready to go. This can include financial documents such as tax returns, income statements, bank statements, and credit reports. You’ll also need to provide the lender with a business plan and any other documents they may request. It’s important to be prepared and organized when submitting your documents to the lender, as this will make the process easier and faster. Having all of the necessary documents ready to go can speed up the approval process and get you the best deal on your commercial mortgage.

Tips for Applying for a Commercial Mortgage

When applying for a commercial mortgage, you should make sure you have all of the necessary information and paperwork ready to go. This includes financial statements, tax returns, a business plan, and other documents. It’s also important to shop around and compare different lenders to find the best rates and terms. You should also make sure you understand the terms and conditions of the loan, as well as any fees or other costs associated with it. Make sure you read through the entire loan agreement so you know exactly what you’re signing up for. Finally, it’s important to be prepared to negotiate and get the best deal for your business. By researching and shopping around for the best commercial mortgage, you can ensure that you get the best deal for your business.