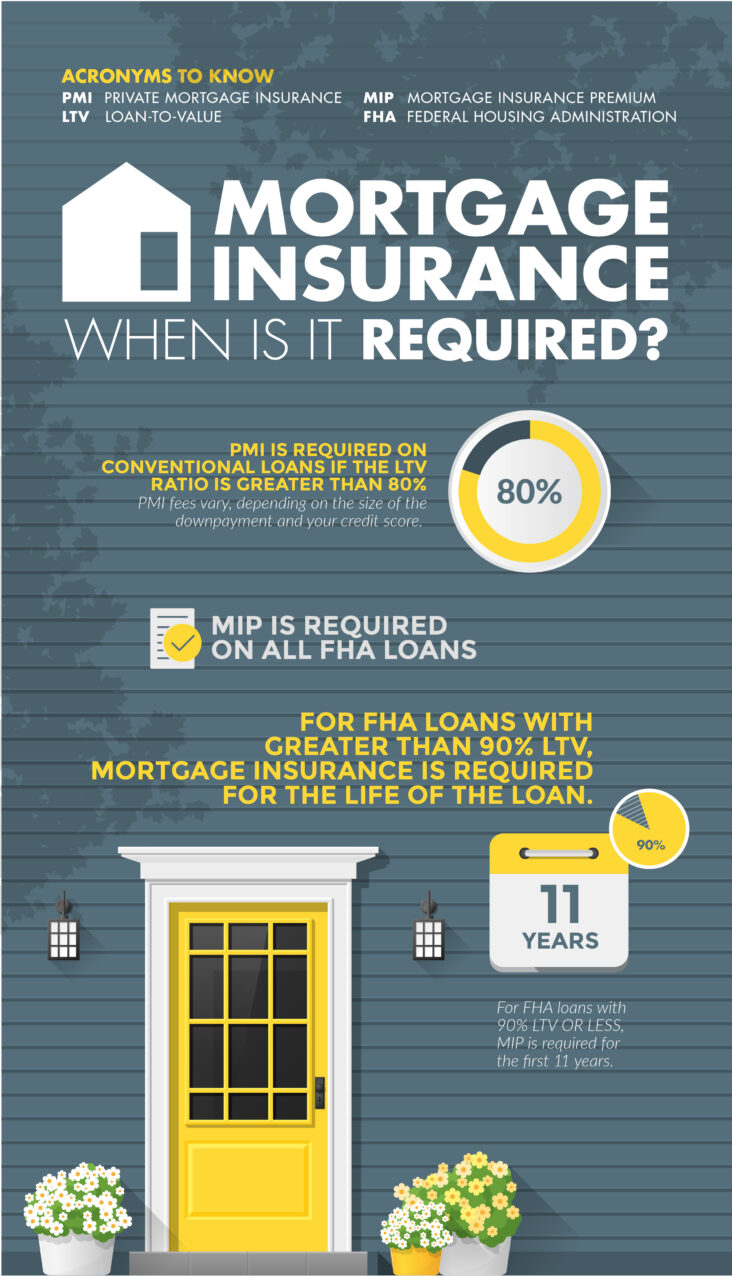

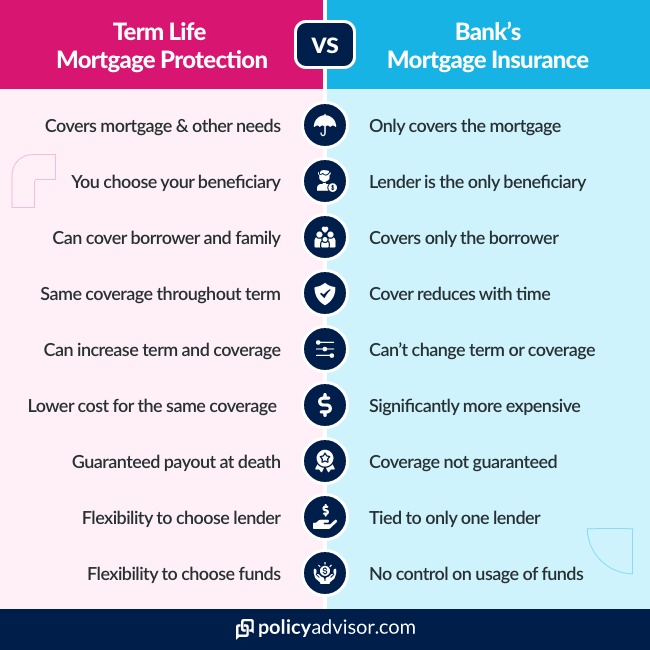

Are you tired of paying mortgage insurance every month and want to know how to get rid of it? If so, you’ve come to the right place! In this article, we will provide you with some helpful information and tips on how to reduce or even avoid mortgage insurance altogether. From understanding the differences between private mortgage insurance (PMI) and mortgage insurance premiums (MIP), to figuring out when you can drop your mortgage insurance, you’ll gain the knowledge you need to make informed decisions about how to get rid of mortgage insurance. So, let’s get started!

Check loan status.

Checking the status of your loan is an important step in determining whether you can get rid of mortgage insurance. Knowing your current loan status can give you the information you need to make informed decisions about your mortgage.

Discuss options with lender.

Discussing your options with your lender is a great way to find out more about how to get rid of mortgage insurance. There may be certain criteria you need to meet in order to be eligible for cancellation.

Make mortgage payments on-time.

Making on-time mortgage payments is essential in order to avoid costly fees and interest rates. Paying your mortgage on time each month can also help you get rid of mortgage insurance more quickly.

Reach 20% equity threshold.

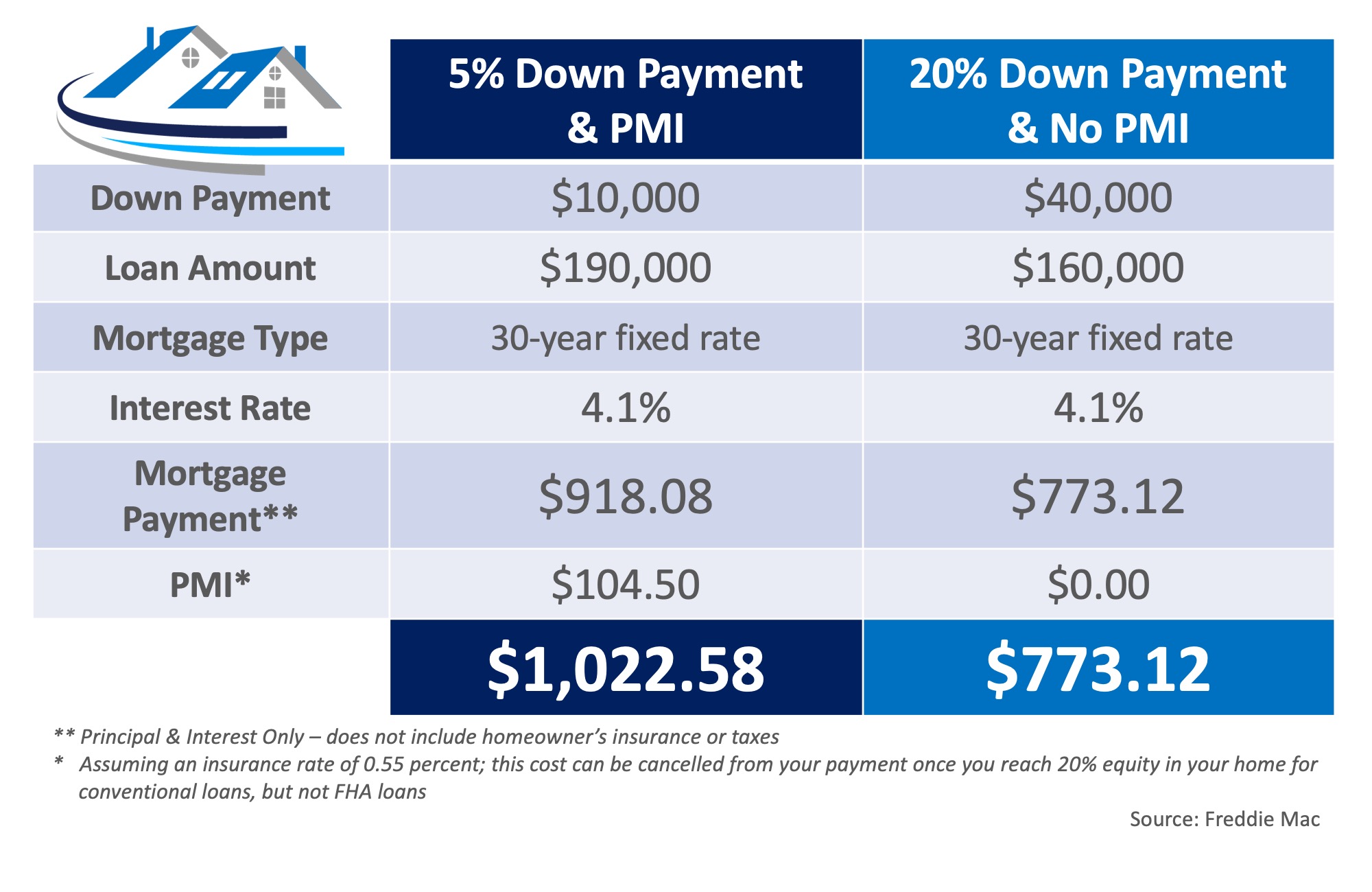

One of the best ways to get rid of mortgage insurance is to reach the 20% equity threshold. This means that you need to pay off enough of your loan so that you owe 80% or less of the home’s current market value. Doing this may help you avoid monthly mortgage insurance payments.

Request PMI cancellation.

Requesting PMI cancellation is a great way to save money on your mortgage. It can be done by proving to your lender that you have at least 20% equity in your home and that you have been making consistent payments on time.

Confirm PMI removal.

Confirming PMI removal is an important step in getting rid of mortgage insurance. Make sure to contact your lender or mortgage servicer to ensure your PMI is removed in a timely manner.