Welcome to our all-encompassing guide on Home Equity Lines of Credit (HELOCs) – your go-to resource for unlocking the financial potential of your home! Dive into the world of HELOCs and discover how you can leverage your home’s value to secure low-interest financing for renovations, debt consolidation, or even that dream vacation. Our comprehensive guide will walk you through every aspect of this popular lending option, from understanding the basics to navigating the application process with ease. Read on to unlock the power of your home equity and transform your financial future!

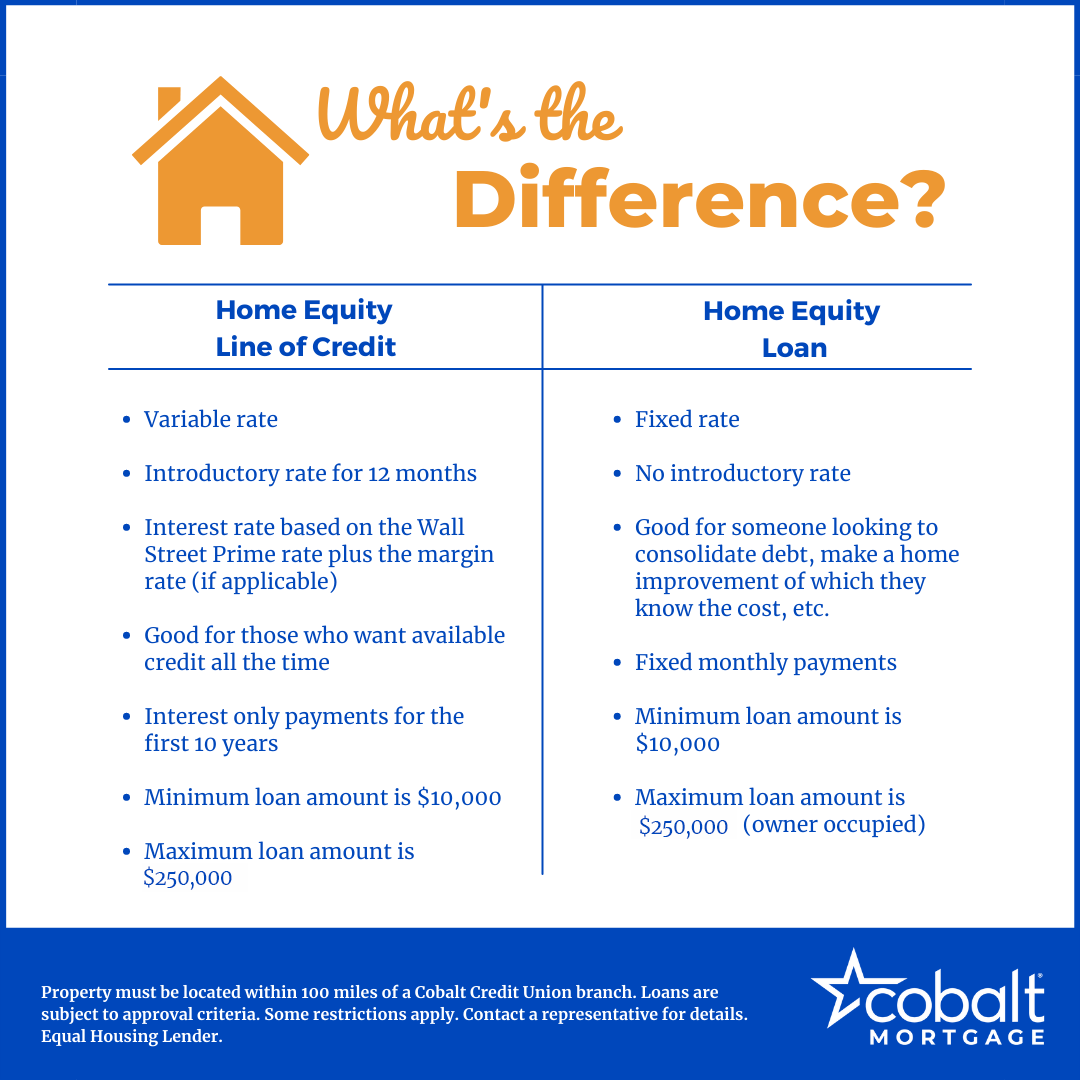

Understand HELOC basics and benefits

Dive into the world of Home Equity Lines of Credit (HELOCs) and uncover the essentials and advantages of this flexible financing option. A HELOC can be a game changer for homeowners seeking extra cash for renovations, debt consolidation, or investments. Let’s explore the basics and benefits of this financial life hack!

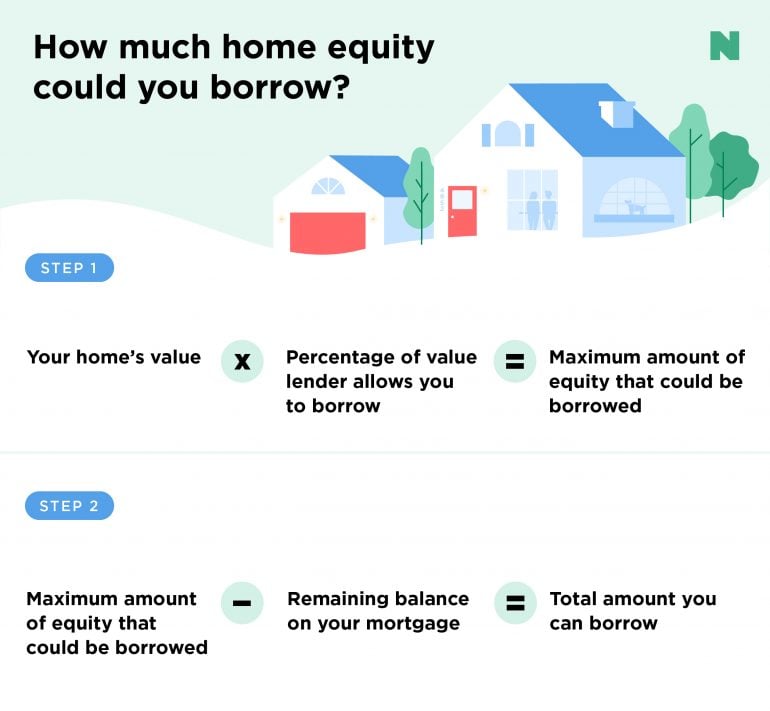

Assess home’s equity and eligibility

Unlock the financial potential of your home with a HELOC by accurately assessing your home’s equity and eligibility. Learn the ins and outs of determining your home’s value, loan-to-value ratio, and your creditworthiness. Empower yourself with the knowledge to leverage your home equity for financial success.

Research and compare lender options

Discover the best HELOC deals by thoroughly researching and contrasting various lender options. Dive deep into interest rates, fees, and repayment terms to make an informed decision. Remember, knowledge is power – so empower your financial future by staying updated on the latest HELOC trends and deals!

Prepare and submit HELOC application

Ready to tap into your home’s equity? Kickstart your HELOC journey by preparing and submitting a well-organized application. Gather necessary documents, like pay stubs and credit reports, and ensure the accuracy of your financial information. A solid application can help you snag low rates and flexible repayment terms. Unlock your home’s potential today!

Evaluate and negotiate loan terms

In your journey to unlock your home’s financial potential, evaluating and negotiating loan terms is crucial. By thoroughly assessing interest rates, fees, and repayment options, you’ll be able to snag a HELOC deal that suits your needs. Remember, being young doesn’t mean you can’t be a savvy negotiator, so don’t be afraid to haggle for the best terms!

Use funds wisely, monitor repayments

Maximize your HELOC benefits by using the funds smartly and keeping a close eye on repayments. Invest in worthwhile home improvements, consolidate high-interest debt or cover emergency expenses. Regularly review your repayment plan to ensure timely payments, protecting your credit score and ensuring financial success.