Are you ready to embark on the exciting journey of home ownership? You’re not alone! With historically low mortgage rates and a booming real estate market, now is the perfect time to turn your dreams into reality. But before you can start shopping for your dream home, you need to ensure you meet the necessary home loan requirements. Fear not, we’ve got you covered with our comprehensive guide on how to meet home loan requirements, packed with expert tips and advice to help you navigate the mortgage application process like a pro. Let’s dive into the world of home loans and get you one step closer to owning your dream home!

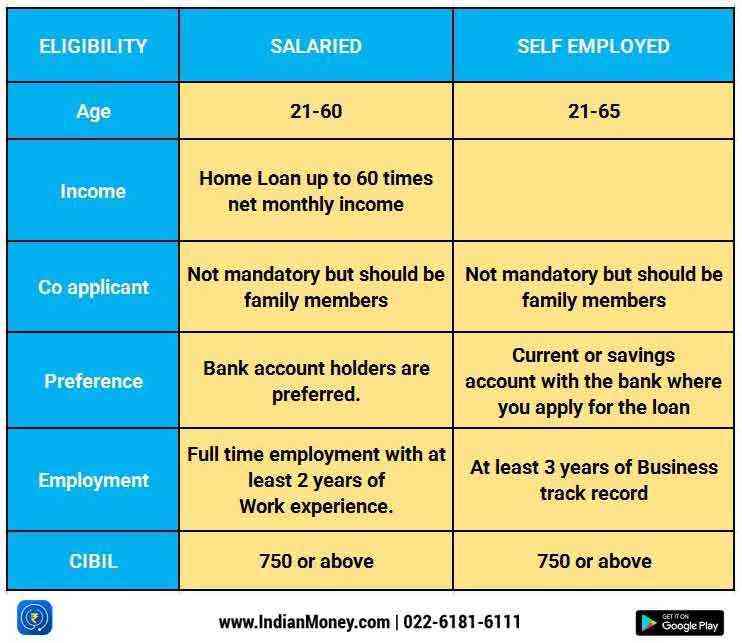

Assess personal finances and credit.

Kickstart your home loan journey by evaluating your personal finances and credit standing. Scrutinize your income, expenses, savings, and debts to determine affordability. Review your credit score and history, as lenders consider these factors when approving loans. A strong financial profile increases your chances of securing a favorable home loan.

Determine budget and loan type.

Kickstart your home loan journey by first determining your budget and the ideal loan type for your needs. This crucial step will help you identify the perfect mortgage fit, streamline your search, and ultimately make your dream home a reality. Remember, a well-planned budget is the key to successful homeownership!

Gather essential documents for application.

Kickstart your home loan journey by assembling all necessary documents for a smooth application process! This includes your identification, proof of income, employment history, credit report, and details about the property you’re eyeing. Be prepared and stay ahead of the game to swiftly secure that dream home!

Compare lenders and interest rates.

Discover the best home loan deals by comparing lenders and interest rates – this will help you score the most favorable terms for your mortgage. Research multiple loan providers, scrutinize their offerings, and make use of online comparison tools to find the perfect match. Secure your dream home with a loan that won’t break the bank!

Get pre-approved for home loan.

Kickstart your home-buying journey by obtaining a pre-approval for a home loan. This step not only strengthens your credibility as a buyer but also helps you understand your budget, making house hunting more efficient. Reach out to lenders, provide necessary documentation, and flaunt that pre-approval letter to secure your dream home!

Maintain financial stability before closing.

Securing your dream home is within reach when you maintain financial stability before closing. Keep your finances in check by avoiding new debt, consistently paying bills on time, and steering clear of job changes. By showcasing monetary responsibility, you’ll sail through the home loan approval process and secure the keys to your new abode.