Are you considering tapping into the equity of your home to secure a comfortable retirement, but aren’t sure where to start? Look no further! Our Comprehensive Guide to Reverse Mortgages: Pros, Cons, and Requirements is here to help you navigate the world of this unique financial solution. Reverse mortgages have gained popularity in recent years as a viable option for seniors seeking financial stability. Yet, it’s crucial to understand the ins and outs of this complex product before making any decisions. Dive into our expert-written guide to discover the benefits, drawbacks, and eligibility criteria of reverse mortgages, ensuring you make an informed choice tailored to your specific needs. Don’t let financial uncertainties keep you from enjoying your golden years — unlock the potential of your home equity today!

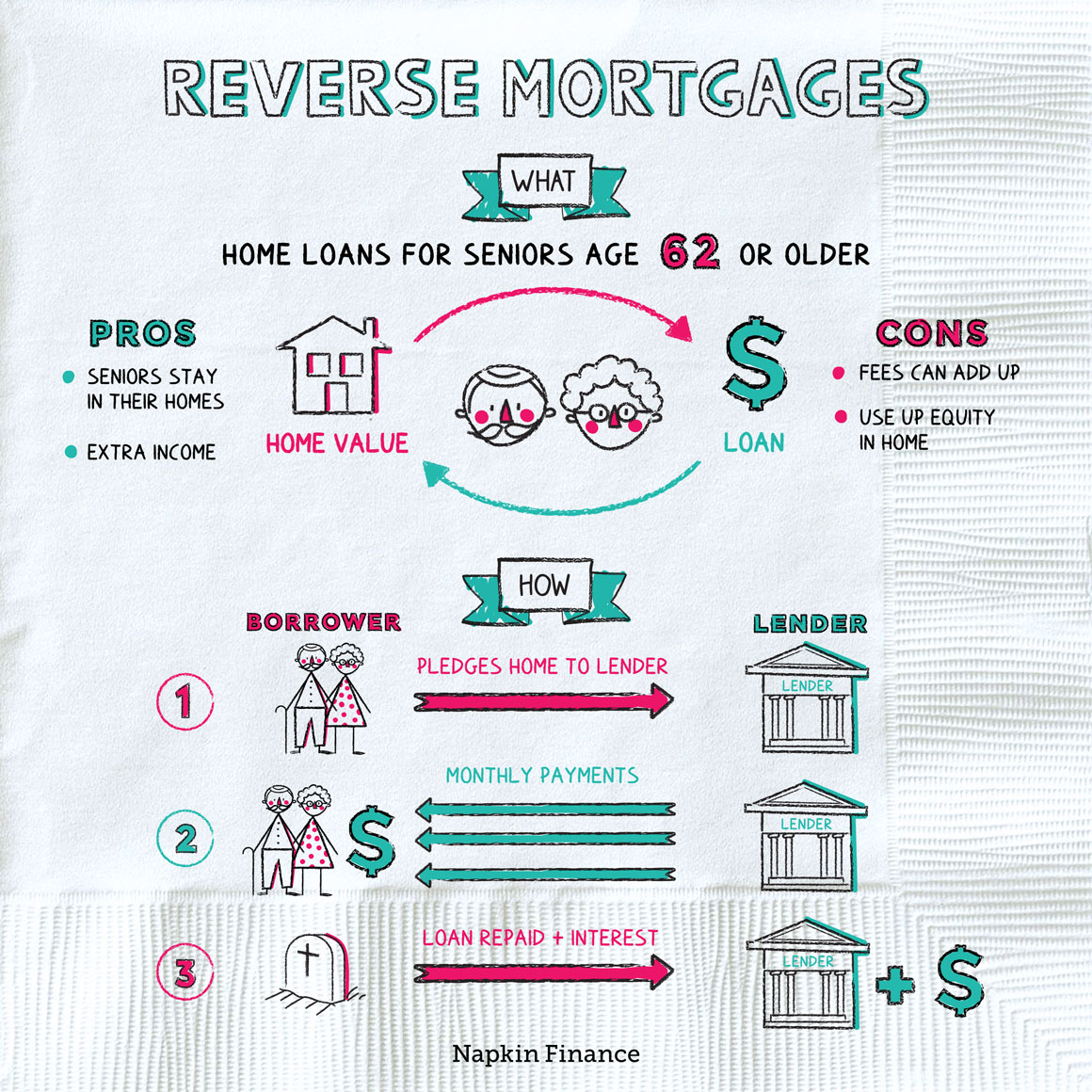

Understand Reverse Mortgage Basics

Dive into our all-inclusive guide on reverse mortgages and grasp the essentials like a pro. Discover the perks and drawbacks, and gain insight into the must-meet requirements. We’ve got the deets you need to make an informed decision, all while keeping it real and relatable. #reversemortgage101

Evaluate Pros and Cons

Dive into our Comprehensive Guide to Reverse Mortgages, where we break down the pros, cons, and requirements of this financial option. Get the 411 on how reverse mortgages can offer a source of income, while understanding potential drawbacks like fees and impact on heirs. Make an informed decision, adulting-style!

Determine Eligibility Requirements

In our Comprehensive Guide to Reverse Mortgages, we dive into the essential eligibility requirements you need to know. As a savvy 21-year-old, you’ll learn the ins and outs of age, property, and financial criteria, ensuring you’re well-informed about this mortgage option. Stay ahead of the game and make smarter decisions with our expert advice.

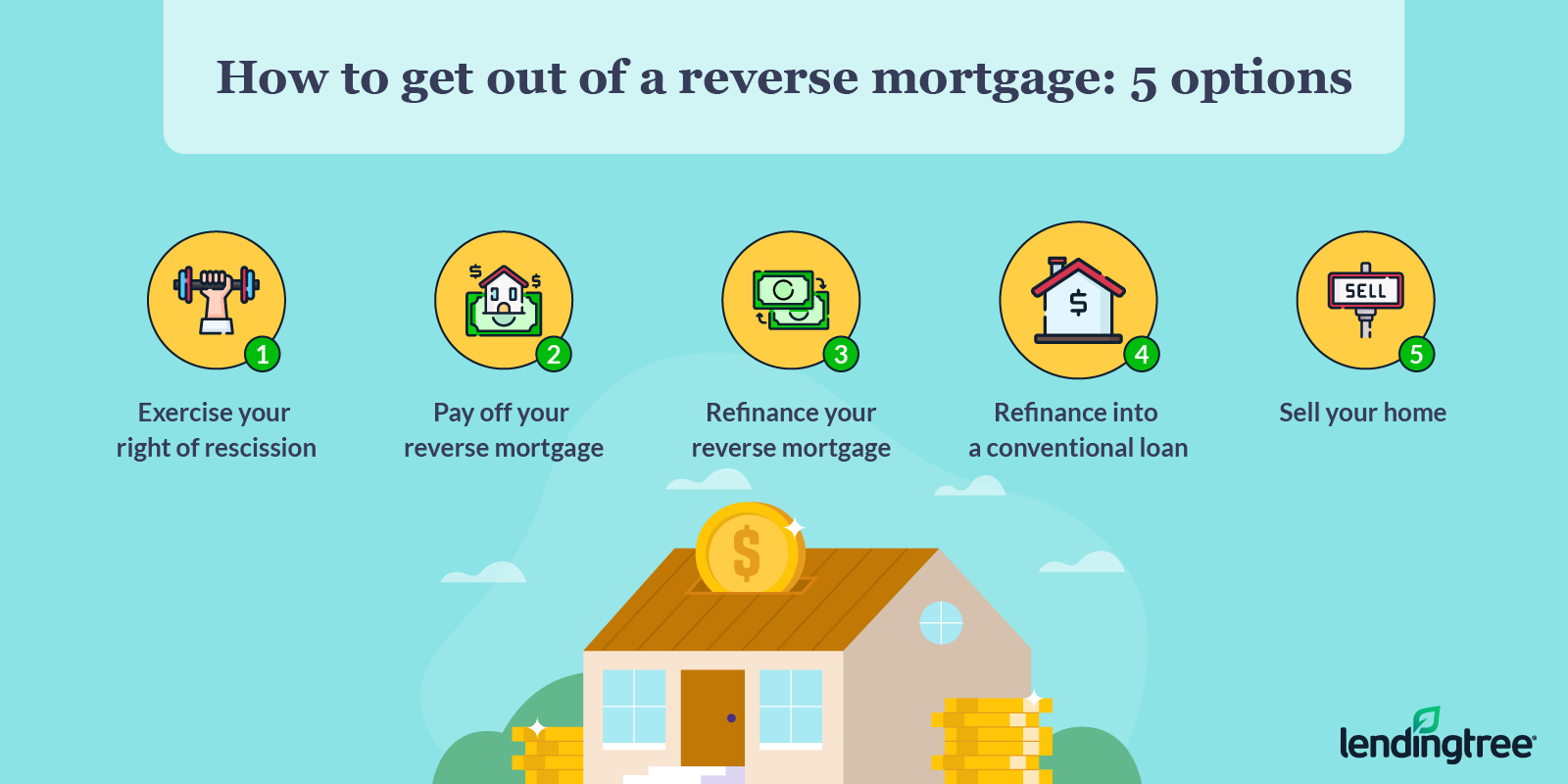

Research Lender Options

Dive into the world of reverse mortgages by researching various lender options. Don’t settle for the first one you find; explore different companies, compare rates, and read reviews to find the best fit for your needs. This crucial step ensures you make an informed decision and score the best deal in town.

Assess Financial Implications

Dive deep into the financial implications of reverse mortgages with our comprehensive guide! Learn the pros, cons, and requirements to make an informed decision. Don’t let financial jargon hold you back, as we break it down for you in a 21-year-old-friendly language. Get ready to become a reverse mortgage whiz!

Consult Trusted Professionals

Don’t navigate the reverse mortgage world solo! Consulting trusted professionals, like financial advisors, mortgage brokers, and real estate attorneys, can provide valuable guidance and help you make informed decisions. Their expertise will ensure you understand the pros, cons, and requirements, ultimately leading to a stress-free, financially secure future.