Are you drowning in a sea of high-interest debt and struggling to stay afloat? Don’t despair! Consolidating your debt with the right personal loan can be your lifesaver. But with numerous options in the market, how do you choose the perfect one for your financial rescue? Fear not, as we’re here to guide you through the process of selecting the ideal personal loan for debt consolidation. From understanding interest rates to evaluating repayment terms, our comprehensive tips will help you navigate the choppy waters of debt relief and sail towards a brighter, debt-free future. Dive in and let’s begin your journey towards financial freedom!

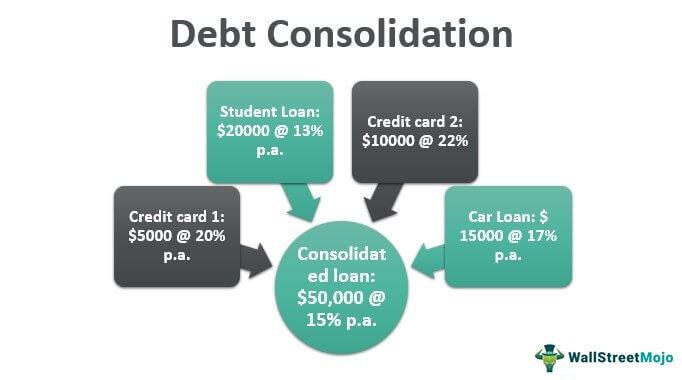

Evaluate current debts and interest rates.

Before consolidating your debt, it’s crucial to assess your current financial situation. Start by evaluating your outstanding debts and their respective interest rates. This will help you determine which debts are the most burdensome, allowing you to prioritize and select a personal loan that offers a lower interest rate to effectively manage your debt.

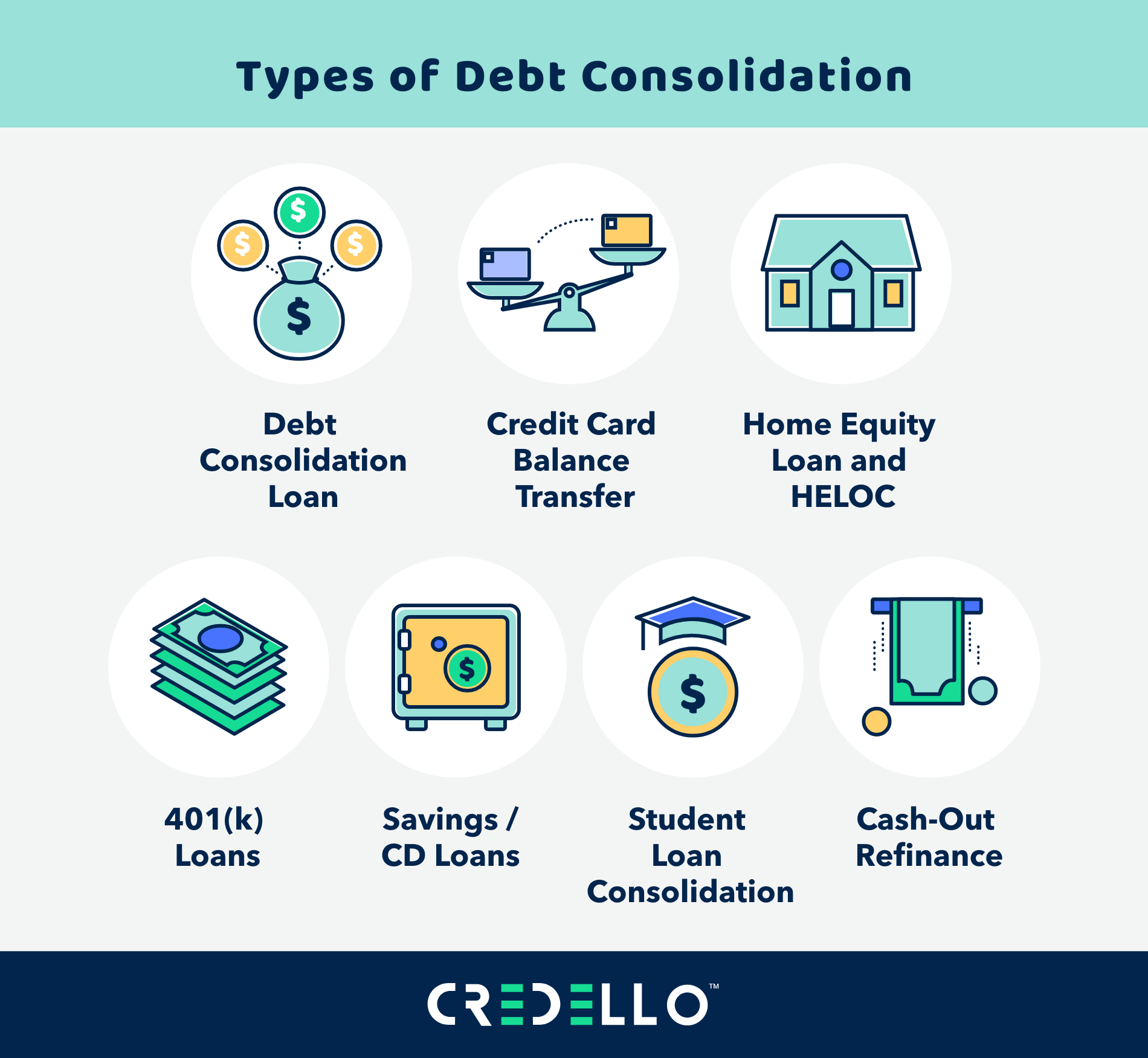

Research lenders and loan options.

Dive deep into researching lenders and loan options to find the best fit for consolidating your debt. Compare interest rates, repayment terms, and customer reviews to ensure you’re choosing a trustworthy lender. Don’t forget to consider factors like loan fees and eligibility criteria. Smart research = smarter debt management!

Compare interest rates and terms.

When selecting the perfect personal loan for debt consolidation, it’s crucial to compare interest rates and terms from various lenders. This way, you can score the most affordable deal and shorten your repayment period. So, take your time to research and analyze offers, ensuring you make a wise decision that lightens your financial burden.

Assess additional fees and penalties.

When consolidating debt, scrutinize additional fees and penalties in potential personal loans. Watch out for hidden costs like origination fees, prepayment penalties, and late payment charges. Being aware of these extra expenses will help you make an informed decision and ensure you’re truly saving money in your debt consolidation journey.

Consider loan repayment flexibility.

When selecting the ideal personal loan for debt consolidation, always consider the loan’s repayment flexibility. Opt for a lender that offers customizable repayment plans, allowing you to tailor your loan term and monthly payments according to your financial situation. This way, you can efficiently manage your debt without straining your budget.

Ensure loan supports debt consolidation.

In your quest to find the perfect personal loan for debt consolidation, make sure the loan explicitly supports this purpose. Not all loans are created equal, so it’s crucial to verify that debt consolidation is an allowed use for the funds. This not only helps streamline your financial situation but also ensures you’re making a smart, informed choice for your future.