Are you drowning in student loan debt and seeking a life raft to stay afloat? Student loan forgiveness programs may be the beacon of hope you’ve been searching for. With various options available, it can be overwhelming to determine if student loan forgiveness is the right choice for you. Our comprehensive guide dives into the nitty-gritty of these programs, helping you navigate the murky waters of student debt relief and make an informed decision about your financial future. Say goodbye to sleepless nights and hello to a debt-free life with our expert advice on student loan forgiveness.

Exploring the Different Types of Student Loan Forgiveness Programs: A Comprehensive Guide

In this comprehensive guide, we’ll explore the various types of Student Loan Forgiveness Programs available to borrowers, ensuring you make an informed decision about your financial future. With options like Public Service Loan Forgiveness, Teacher Loan Forgiveness, and Income-Driven Repayment Forgiveness, it’s essential to understand the eligibility criteria, application process, and benefits of each program. Navigating the complexities of student loan forgiveness can be daunting, but our detailed analysis will provide clarity and direction, allowing you to confidently determine if student loan forgiveness is the right choice for your unique financial situation.

Assessing Your Financial Situation: Key Factors to Consider Before Applying for Student Loan Forgiveness

Before applying for student loan forgiveness, it’s crucial to evaluate your financial situation thoroughly. Start by examining your current income, monthly expenses, and outstanding debt to determine if forgiveness is the most practical option for you. Assess the potential impact on your credit score, as well as any tax implications that may arise from having loans forgiven. Additionally, consider your long-term financial goals and whether pursuing forgiveness aligns with those objectives. By taking these essential factors into account, you can make an informed decision about whether student loan forgiveness is the right choice for your financial future.

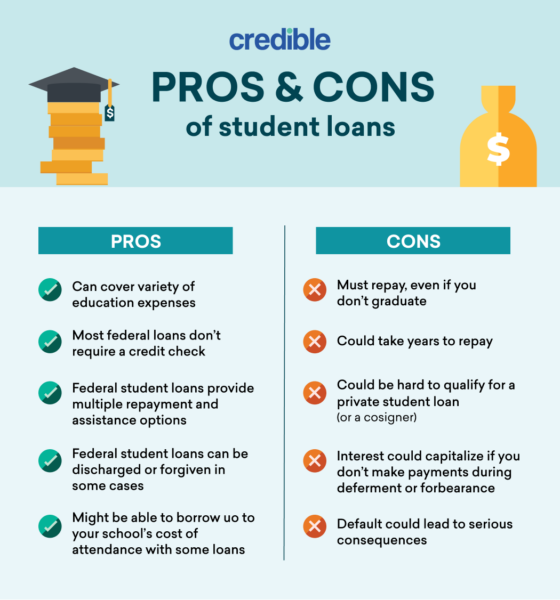

Pros and Cons of Student Loan Forgiveness: Weighing the Benefits and Drawbacks

When considering student loan forgiveness, it’s essential to weigh the pros and cons to determine if it’s the right choice for you. On the positive side, loan forgiveness can significantly reduce or eliminate your student debt, providing financial relief and the opportunity to focus on other financial goals. However, it’s crucial to understand that not everyone qualifies for forgiveness programs, and there may be strict eligibility requirements to meet. Additionally, forgiven loans could be considered taxable income, and the process can be time-consuming. By carefully evaluating the benefits and drawbacks of student loan forgiveness, you can make an informed decision that best suits your financial situation and long-term goals.

How to Maximize Your Chances of Qualifying for Student Loan Forgiveness: Expert Tips and Strategies

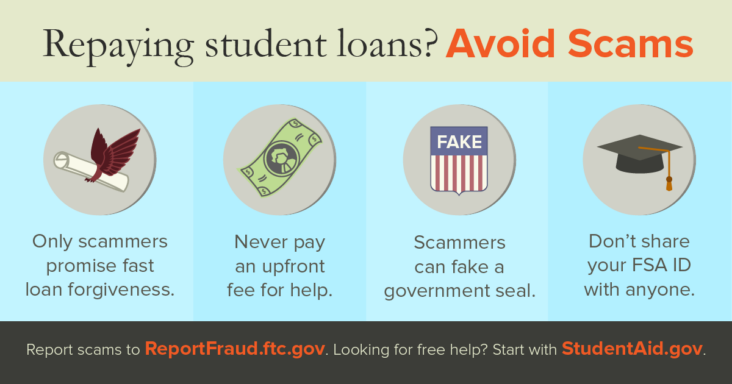

To maximize your chances of qualifying for student loan forgiveness, it’s crucial to understand the eligibility criteria and strategize accordingly. First, research the various forgiveness programs, such as Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, or Income-Driven Repayment (IDR) forgiveness. Ensure that you have the right type of federal loans, as not all are eligible for forgiveness. Next, enroll in an appropriate repayment plan, and consistently make on-time payments. Keep detailed records and stay updated on policy changes. Lastly, consider seeking professional advice from a student loan expert to help navigate the process and make well-informed decisions.

Life After Student Loan Forgiveness: Preparing for a Debt-Free Future and Achieving Financial Freedom

Embarking on life after student loan forgiveness can be a liberating and exciting journey towards financial freedom. With the weight of debt off your shoulders, it’s essential to strategize and plan for a prosperous future. Start by creating a realistic budget, prioritizing savings, and investing in retirement plans. Establish an emergency fund that can cover at least 3-6 months of living expenses for unexpected setbacks. Consider seeking professional financial advice to optimize your newfound financial capabilities and explore options for wealth-building, such as real estate or stock market investments. By following these steps, you can lay the foundation for a secure and debt-free life, truly reaping the benefits of student loan forgiveness.