Are you struggling with mounting student loan debt and seeking a financial reprieve? Discover the answers to all your pressing questions about Student Loan Forgiveness Programs in our comprehensive guide! Unravel the complexities of these beneficial schemes, learn about the eligibility criteria, and unlock the secrets to reducing or even eliminating your student loan burden. Don’t let debt shackle your future – dive into our insightful FAQ resource and embark on your journey towards financial freedom today!

Understanding the Different Types of Student Loan Forgiveness Programs: A Comprehensive Guide

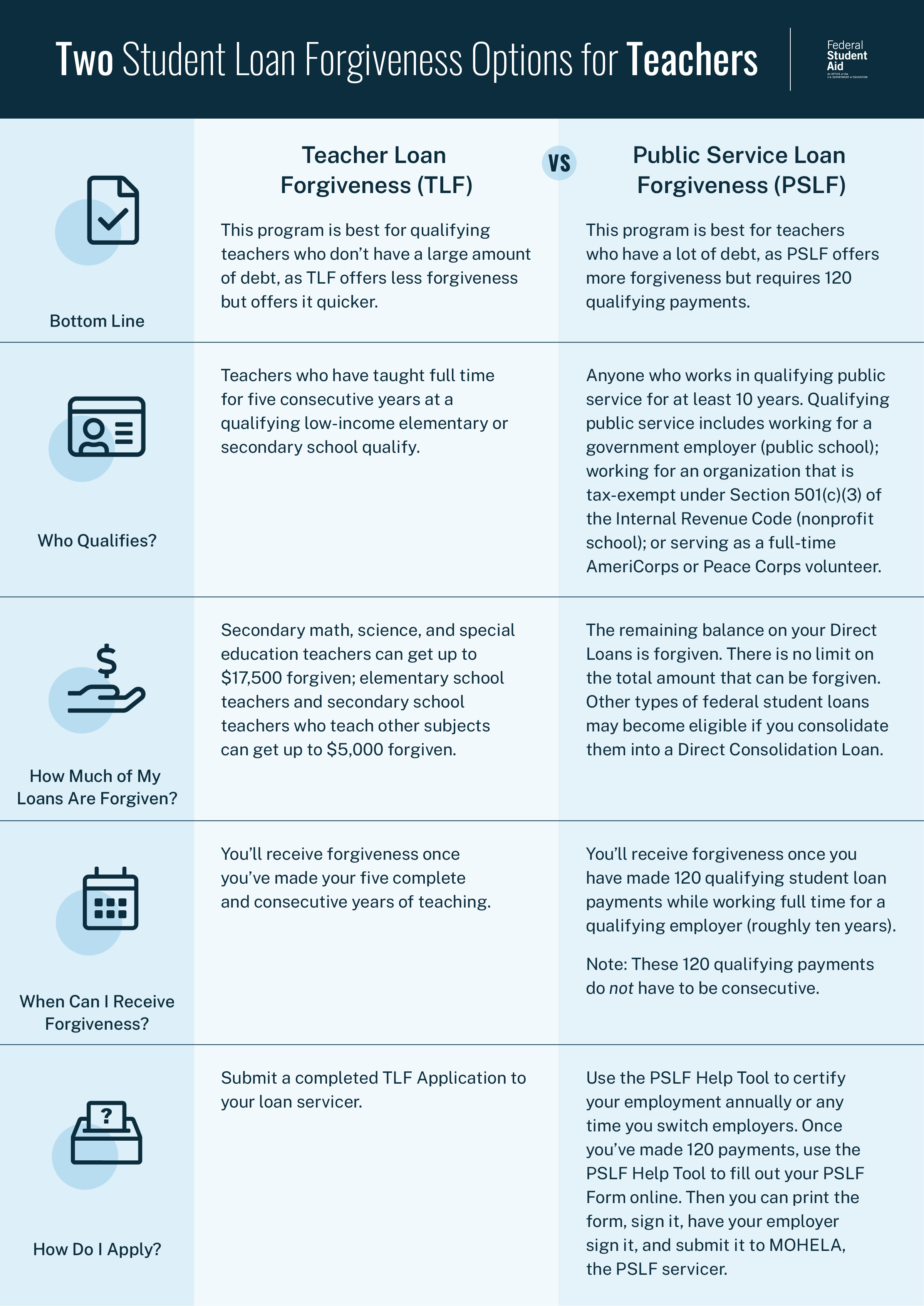

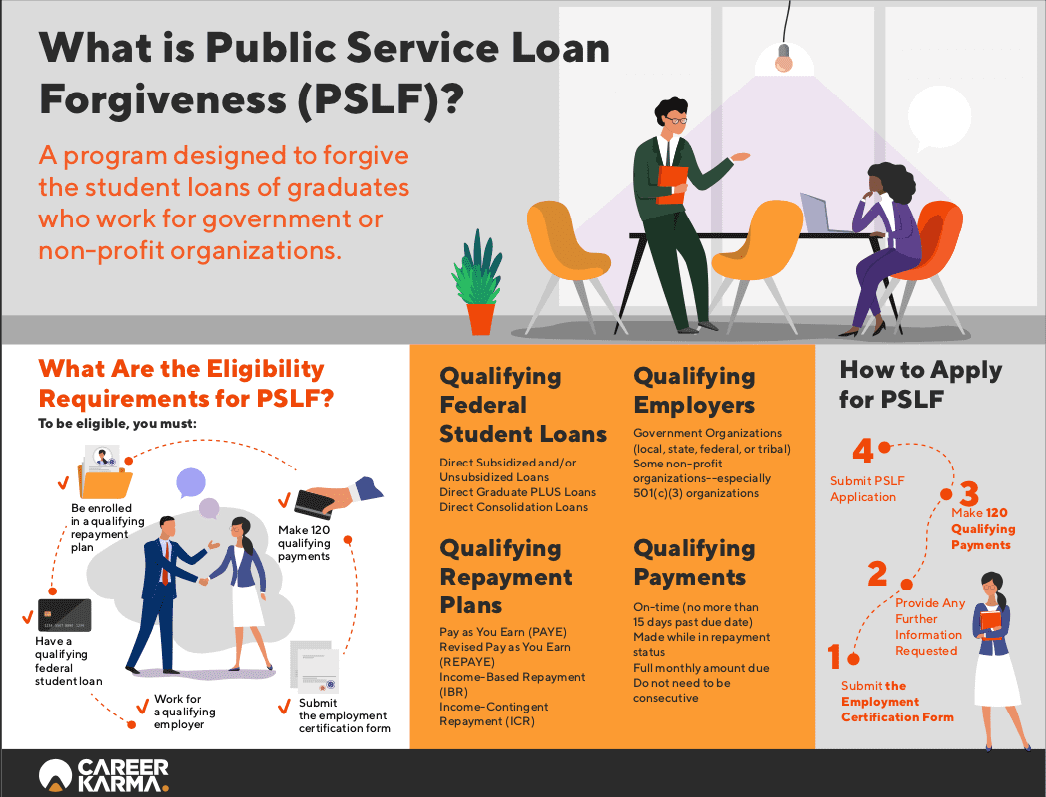

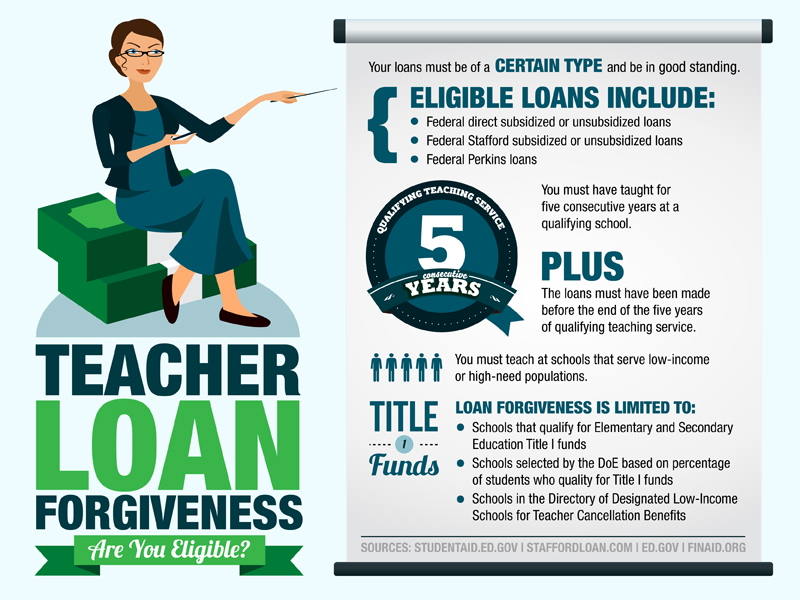

Dive into our comprehensive guide to understanding the different types of Student Loan Forgiveness Programs available, which can provide significant financial relief to those in need. Our detailed overview covers the various options, including Public Service Loan Forgiveness, Teacher Loan Forgiveness, Income-Driven Repayment Forgiveness, and more. Learn about eligibility criteria, application processes, and potential benefits to make informed decisions about your student loan repayment journey. With proper knowledge and planning, you can navigate the complexities of student loan forgiveness and potentially save thousands of dollars. Empower yourself to take control of your financial future by exploring these valuable resources.

Debunking Common Myths Surrounding Student Loan Forgiveness: Separating Fact from Fiction

Debunking Common Myths Surrounding Student Loan Forgiveness: Separating Fact from FictionIn this insightful blog section, we uncover the truth behind popular misconceptions about student loan forgiveness programs to help you make informed decisions. Many borrowers often believe that loan forgiveness is an easy, automatic process, or that it’s reserved only for specific professions like teachers and public servants. We’ll break down these myths and shed light on the actual requirements, qualifications, and application process for various loan forgiveness programs. With accurate information at your fingertips, you can confidently navigate the world of student loan forgiveness, optimize your repayment strategy, and secure a brighter financial future.

Exploring the Eligibility Criteria for Student Loan Forgiveness Programs: What You Need to Know

Understanding the eligibility criteria for student loan forgiveness programs is essential for borrowers seeking relief from their educational debt. To qualify for these programs, you typically need to work in a specific profession, such as teaching or public service, and meet the required service years. Additionally, you must have a qualifying loan type, like a Direct Loan, and be enrolled in an eligible repayment plan, often an income-driven plan. Familiarizing yourself with the various forgiveness programs, such as Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness, can help you navigate the application process and maximize your chances of approval. Stay informed and explore all available options to achieve financial freedom from student loans.

Navigating the Application Process for Student Loan Forgiveness: A Step-by-Step Walkthrough

Navigating the application process for student loan forgiveness programs can be daunting, but with a clear, step-by-step walkthrough, securing a brighter financial future is within reach. Begin by determining your eligibility for various forgiveness programs, such as Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, or Income-Driven Repayment (IDR) forgiveness. Next, gather essential documents and complete the required application forms. Stay on top of deadlines and ensure you meet all criteria, including making consistent, qualifying payments. Lastly, maintain communication with your loan servicer, as they can provide valuable guidance and support throughout the application process. With these steps, you’ll be on your way to alleviating the burden of student loan debt.

Maximizing Your Student Loan Forgiveness Benefits: Expert Tips and Strategies for Success

Maximizing your student loan forgiveness benefits is essential to achieving long-term financial success. To do this, it’s crucial to stay informed about the latest expert tips and strategies. Start by selecting the appropriate forgiveness program that aligns with your career goals and financial needs. Ensure you’re enrolled in the best repayment plan, such as an income-driven repayment plan, to minimize your monthly payments. Regularly track your qualifying payments and maintain accurate records to avoid any discrepancies. Lastly, explore additional options, such as employer-sponsored repayment assistance or grant opportunities, to further reduce your student loan debt. By staying proactive and informed, you’ll be on the path to maximizing your student loan forgiveness benefits.