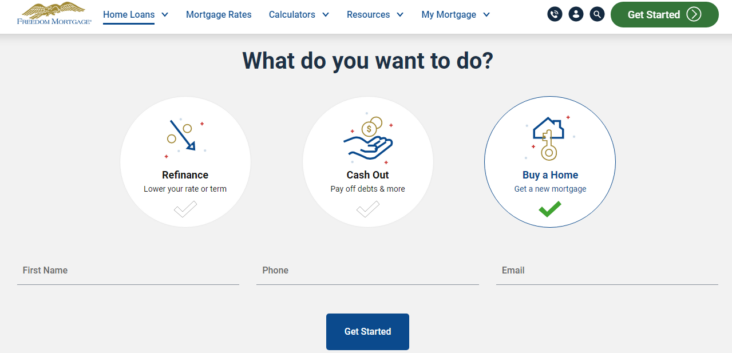

Are you in search of the perfect mortgage loan to finance your dream home? Look no further – Freedom Mortgage is here to help! As a leading provider of mortgage solutions, Freedom Mortgage offers a variety of loan options tailored to suit your unique needs. In this comprehensive guide, we will explore the essential factors to consider when choosing the right Freedom Mortgage loan for you. From comparing interest rates to understanding different loan types, we’ll equip you with the knowledge and confidence to make an informed decision. So, let’s dive into the world of mortgage loans and discover how to find the ideal fit for your financial goals and lifestyle.

Evaluate personal financial situation thoroughly.

Before diving into the world of Freedom Mortgage loans, it’s crucial to thoroughly assess your personal financial situation. Consider factors like your credit score, monthly income, and debt-to-income ratio. This way, you’ll have a clear understanding of your borrowing capacity and better position yourself to choose the loan that fits your needs.

Research different loan types offered.

Dive deep into exploring various loan types Freedom Mortgage presents, peeps! Know your options – from conventional loans and government-backed FHA, VA, USDA loans to refinancing schemes. Research, compare, and conquer – pick the perfect loan type that vibes with your financial goals and credit status. Let’s adult like a pro!

Compare interest rates and terms.

When choosing the perfect Freedom Mortgage loan, keep a keen eye on interest rates and terms. Comparing these factors will help you strike the best deal and save money in the long run. Remember, lower interest rates and flexible repayment terms are your friends in this journey to financial freedom!

Consider loan repayment period carefully.

In the quest for your dream home, carefully ponder the loan repayment period. This crucial factor impacts your monthly payments and total interest paid. Take time to weigh shorter vs. longer terms and align your choice with your financial goals. Remember, the right loan term can make homeownership a breeze!

Assess down payment and fees.

When selecting the perfect Freedom Mortgage loan, it’s crucial to carefully evaluate your down payment and associated fees. By examining your financial situation and comparing various loan options, you can find the right balance between upfront costs and long-term savings, ensuring a stress-free home buying experience.

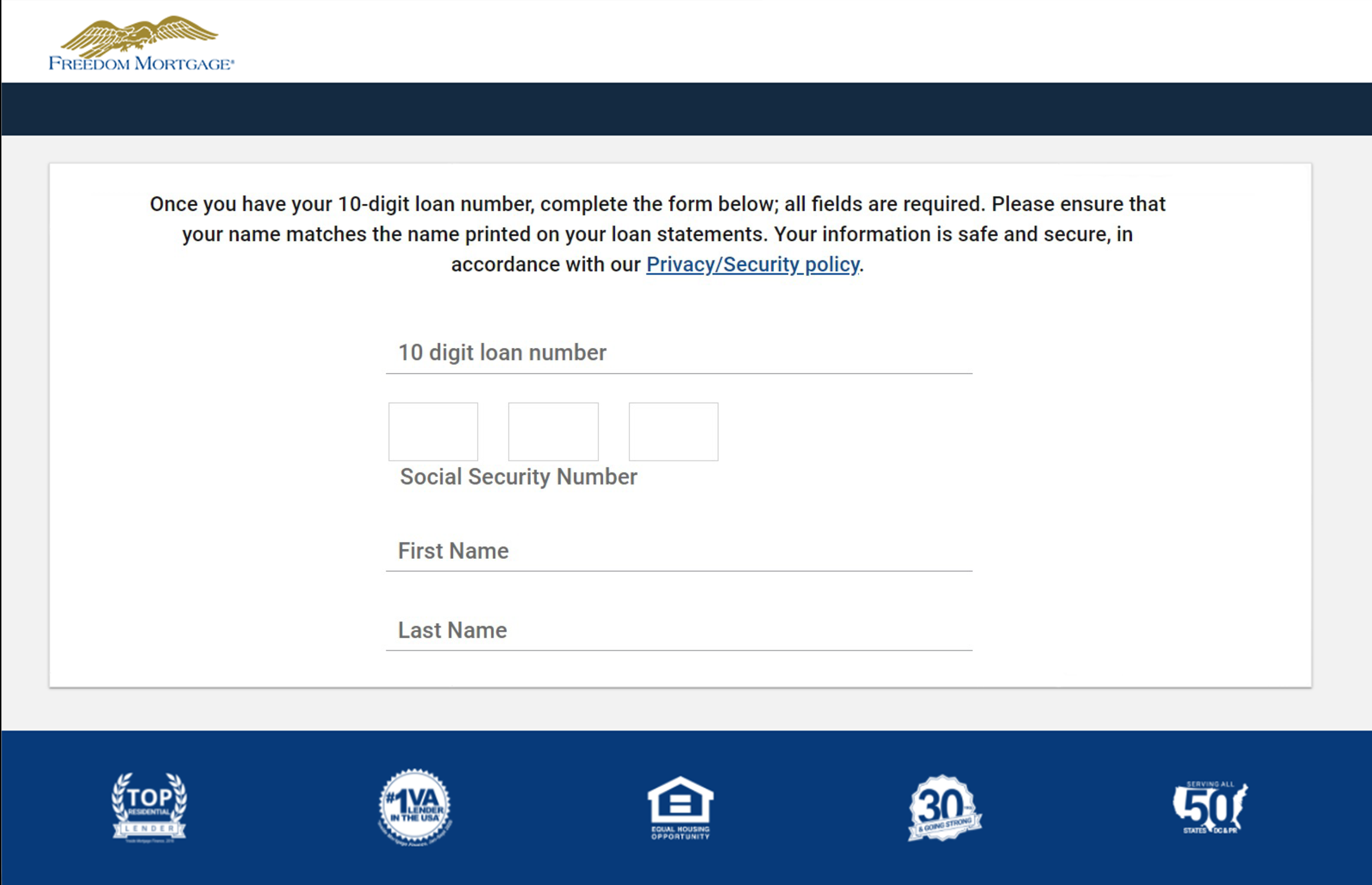

Consult professional for personalized advice.

Don’t hesitate to seek expert guidance when selecting the perfect Freedom Mortgage loan for your unique needs. By consulting a professional, you’ll receive personalized advice tailored to your financial goals and lifestyle, ensuring you make a well-informed decision. Remember, the right mortgage can make all the difference in your homeownership journey!