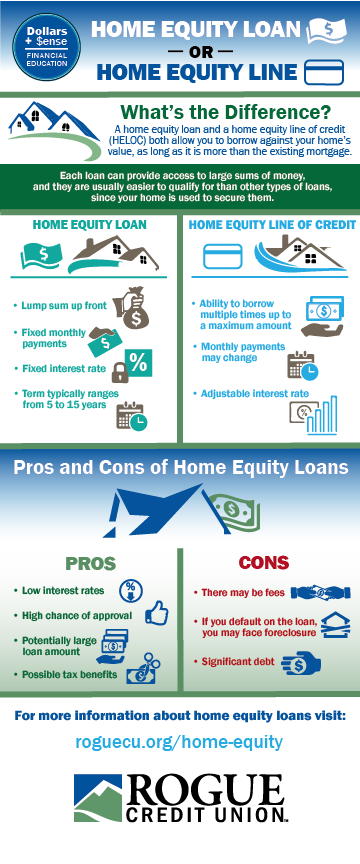

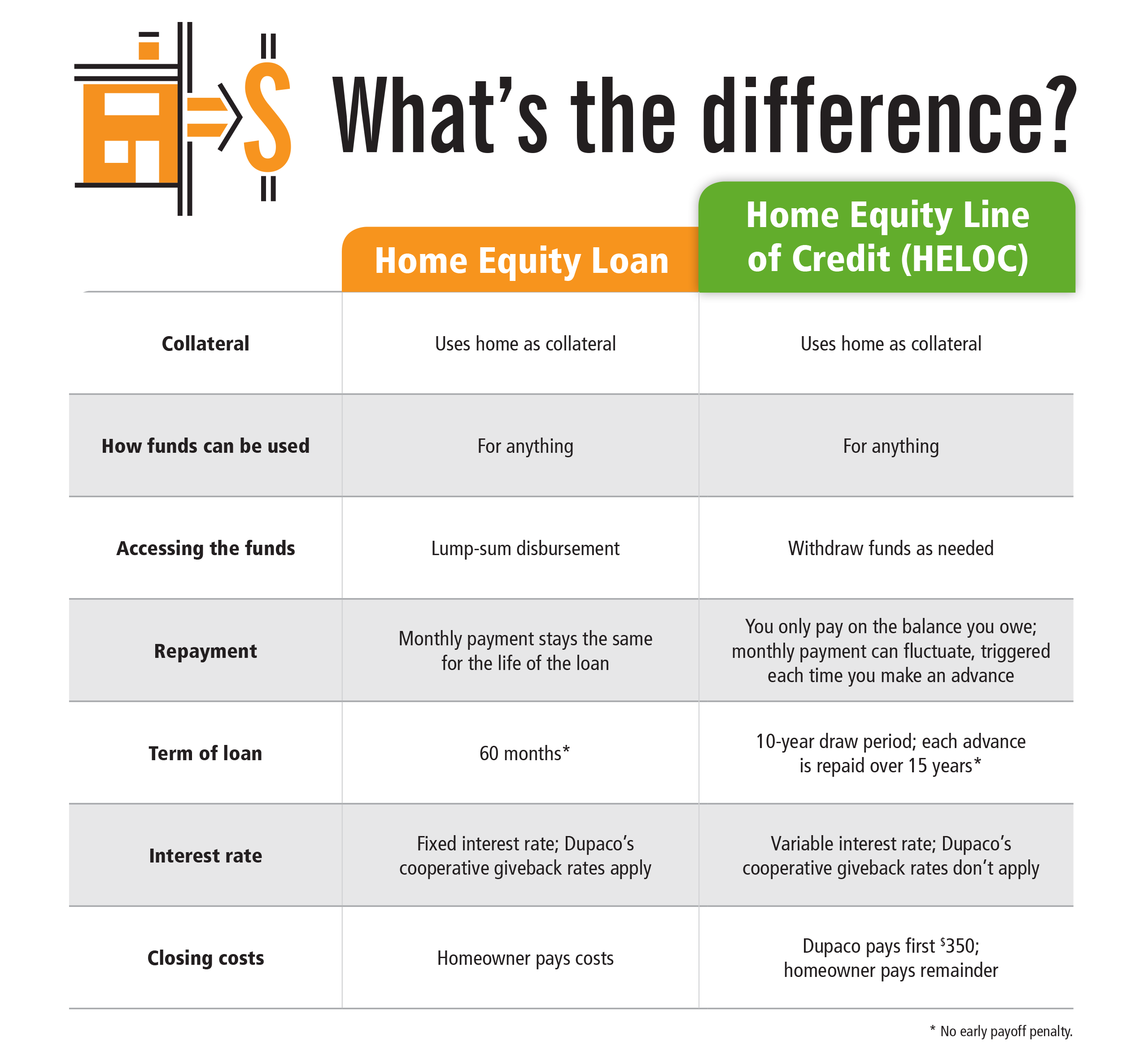

Getting a Home Equity Loan is a great way to get the money you need for a big purchase, like a car, home improvements, or even to consolidate debt. As an 18-year-old student, you may be wondering what steps you need to take to get approved for a Home Equity Loan. Don’t worry, I’m here to help you understand the process, so you can make the best decision for you and your financial future. In this article, I’ll explain the ins and outs of Home Equity Loans, so you can get the cash you need in no time.

Research lenders

Doing some research into home equity loans can be daunting, but it’s well worth your time. Start by looking into local banks, credit unions and online lenders. Compare the interest rates, fees and other loan features to find the best deal for you. Also, it’s important to read reviews from previous customers to make sure you’re dealing with a reputable lender.

Compare rates

If you’re looking to get a home equity loan, it’s important to compare rates from different lenders. Shopping around can help you get the best deal and save you money in the long run. I’m an 18-year-old student and even I know that it pays to do your research and compare rates before signing on the dotted line. With all the options out there, there’s no reason not to take the time to find the best lender for you.

Gather documents

If you’re looking to get a home equity loan, the first step is to gather all the necessary documents. Make sure to have your income tax returns, bank statements, and proof of residence ready. Additionally, it will help to have your credit score and debt-to-income ratio handy. Getting everything together beforehand will make the process much smoother.

Calculate loan size

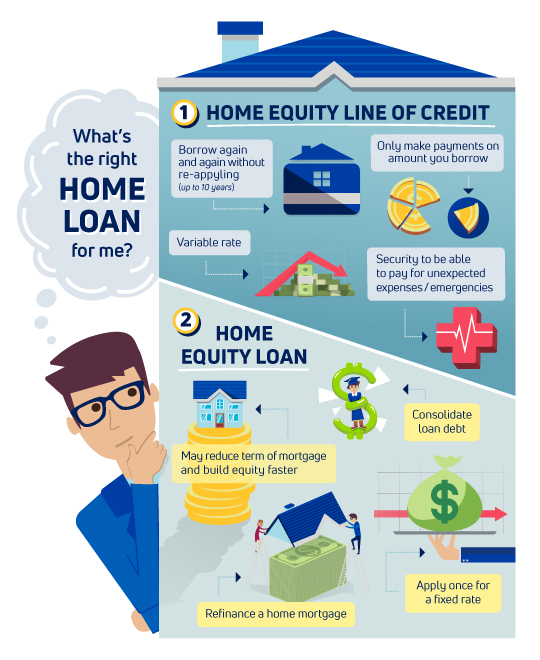

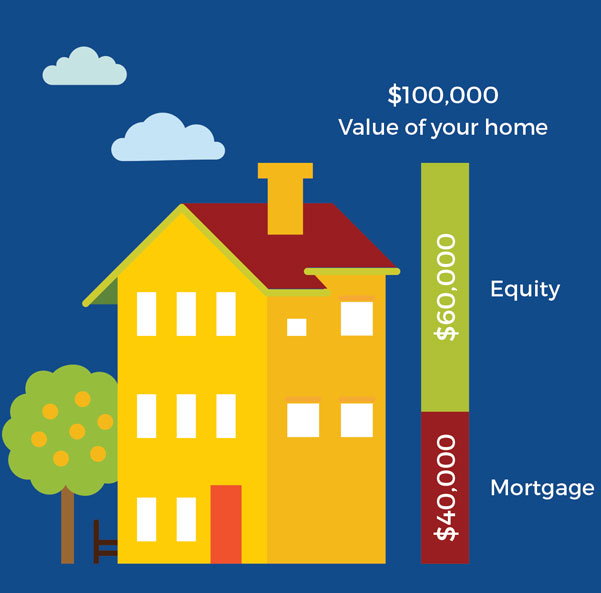

Calculating the size of your Home Equity Loan can be tricky, but with a few simple steps you can figure out how much you’re eligible for. Firstly, you need to know your home’s current value and subtract any liens or mortgages you may have on it. You also need to factor in your credit score, income, and other financial obligations. Lastly, you need to compare different lenders and see what interest rates they offer. With the right calculations, you can get the loan size that fits your needs.

Apply for loan

Applying for a home equity loan can seem intimidating, but it doesn’t have to be! Start by gathering your financial documents like pay stubs, tax return, and bank statements. Then, find a reputable lender who can offer you a loan that fits your budget. Lastly, fill out the application and provide the necessary documentation. It’s that easy and you could get your home equity loan in no time!

Receive funds

Receiving funds from a home equity loan is easy and fast. You can get your funds quickly and without hassle, whether you’re 18 years old or older. You’ll need to provide proof of income and have a good credit score to qualify, but if you do, you can expect to receive your funds within a few days. Plus, you can use your home equity loan funds for anything you need, from home repairs to college tuition.