If you’re a young adult looking to buy your first house, you probably have a lot of questions about mortgages. What’s the difference between a FHA and conventional mortgage? How do you know which one is right for you? Not to worry, I’m here to break it down and make it easy to understand! Let’s get into understanding the difference between FHA and conventional mortgages so you can make the best decision for your future.

Research mortgage types

If you’re researching mortgages, it can be confusing to understand the differences between FHA and conventional mortgages. It’s important to understand the pros and cons of each type of mortgage before you decide which is right for you. Make sure to read up on the different types of mortgages, speak to a financial advisor, and compare rates and terms to get the best deal possible.

Compare FHA & conventional

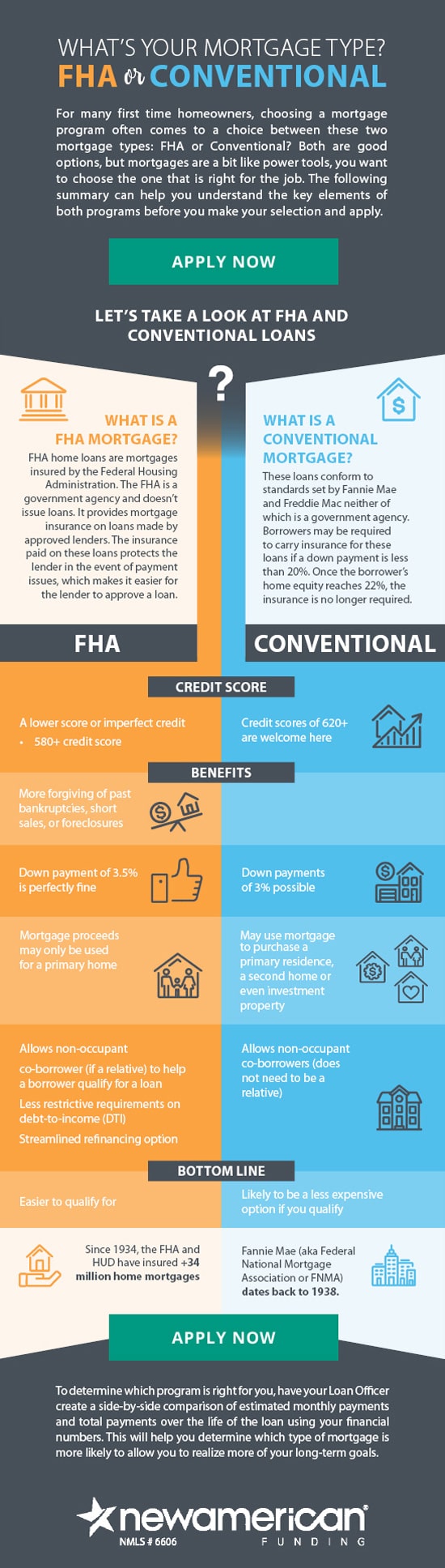

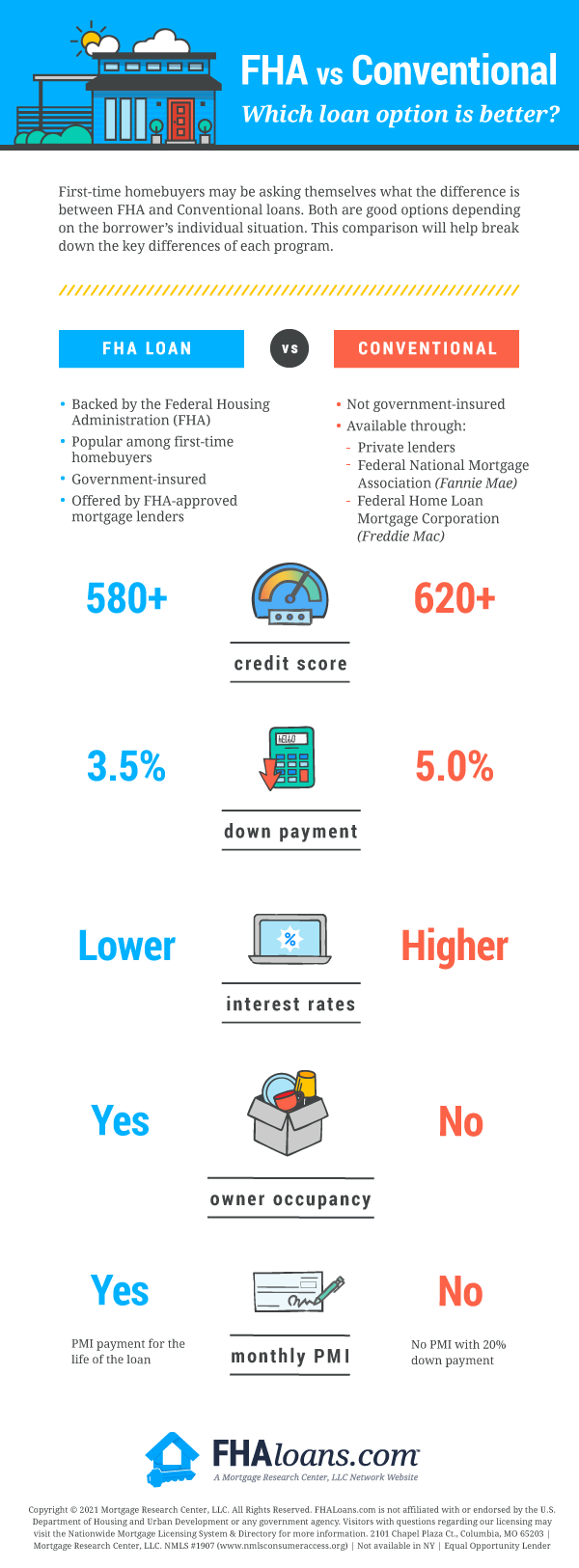

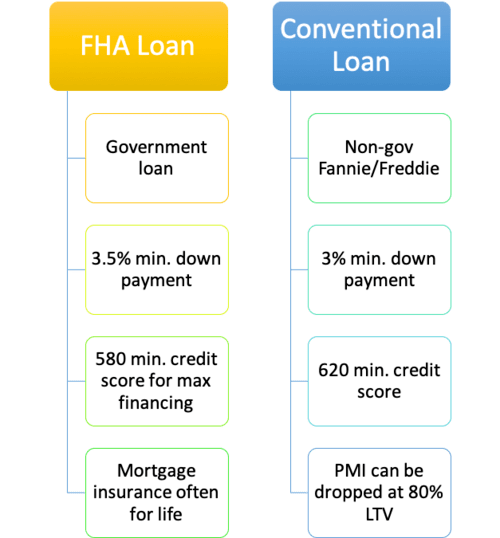

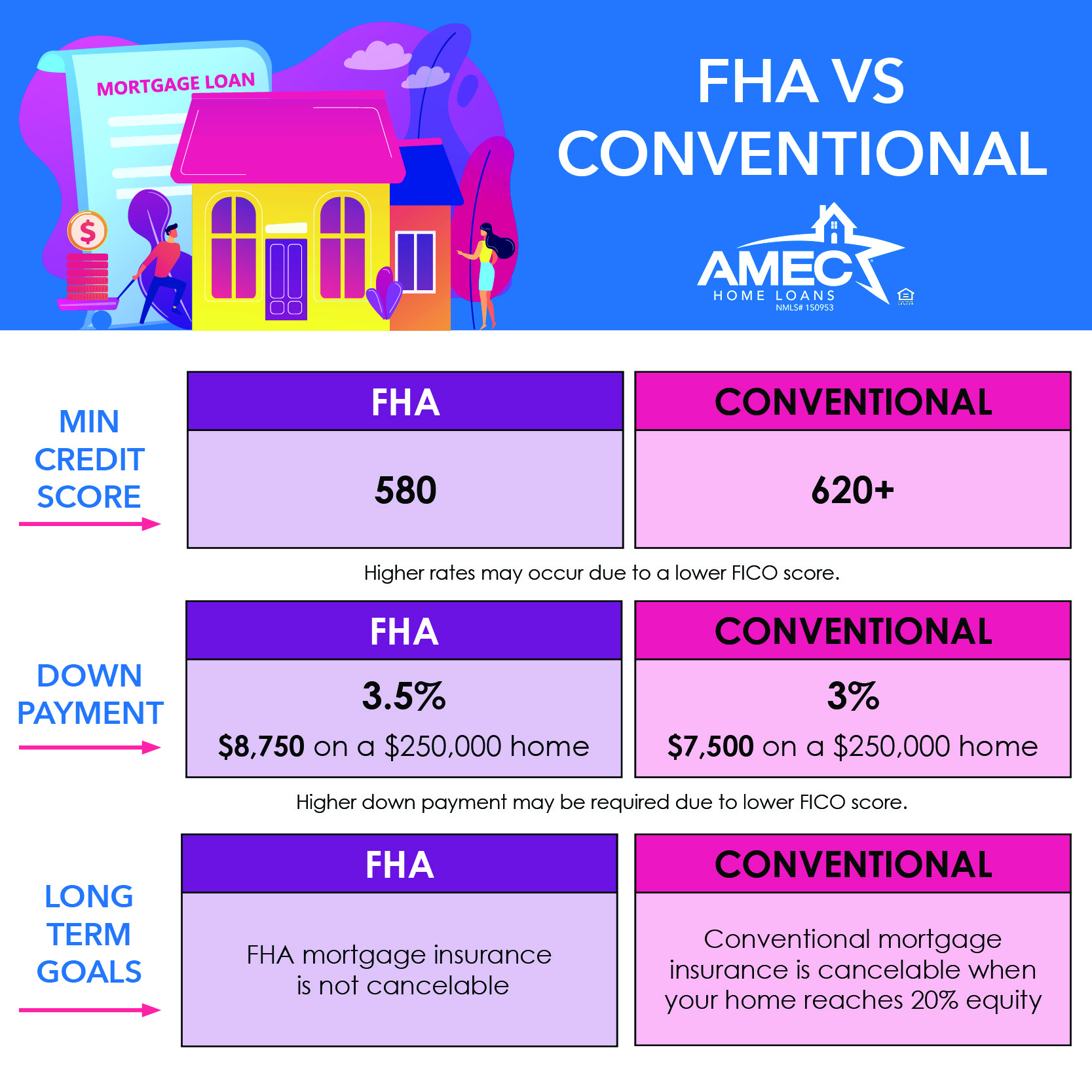

Figuring out the difference between FHA and conventional mortgages can be tricky. FHA mortgages are government-insured, meaning they have more flexible requirements, but come with higher fees and mortgage insurance premiums. Conventional mortgages don’t have the same standards, but can often come with lower interest rates. Ultimately, you’ll need to do your research to find the best mortgage that fits your needs.

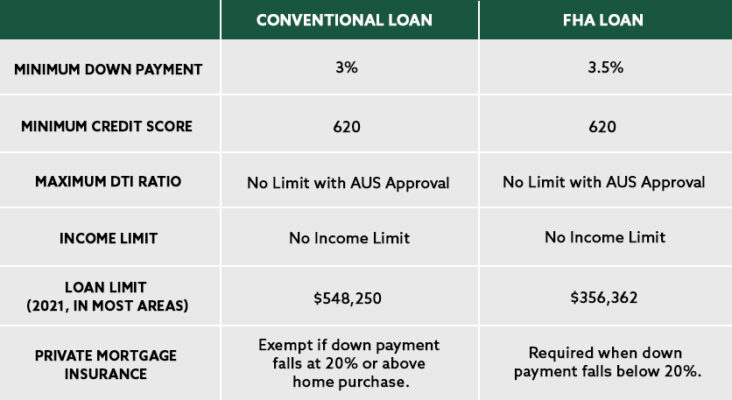

Analyze loan requirements

Comparing a FHA mortgage to a conventional mortgage could be confusing. To make the best decision, analyze the loan requirements for each type. FHA loans usually require a lower down payment and credit score than conventional loans, but may have higher closing costs and mortgage insurance premiums. It’s important to weigh the pros and cons of each loan program to determine which option is best for you.

Compare interest rates

Figuring out the difference between FHA and conventional mortgages can be a bit daunting. It’s important to compare interest rates when deciding which loan is best for you. FHA loans typically have lower interest rates than conventional loans, making them more attractive for those who don’t have a large down payment. You should also consider the loan terms, fees, and other costs associated with each loan. Remember, the lower the interest rate, the more money you’ll save over the life of the loan.

Understand down payment

Understanding the difference between FHA and conventional mortgages can be complicated, but it doesn’t have to be. For starters, FHA loans require a lower down payment – often as low as 3.5% of the purchase price. Conventional mortgages, on the other hand, typically require a minimum of 5% down. Keep in mind that the higher your down payment is, the lower your interest rate will be.

Consider closing costs

When it comes to closing costs, it’s important to understand that FHA mortgages usually require more upfront costs than conventional mortgages. FHA loans typically require a down payment of 3.5%, along with additional fees for things like mortgage insurance and other closing costs. On the other hand, conventional mortgages may have higher closing costs, but often require less money upfront.