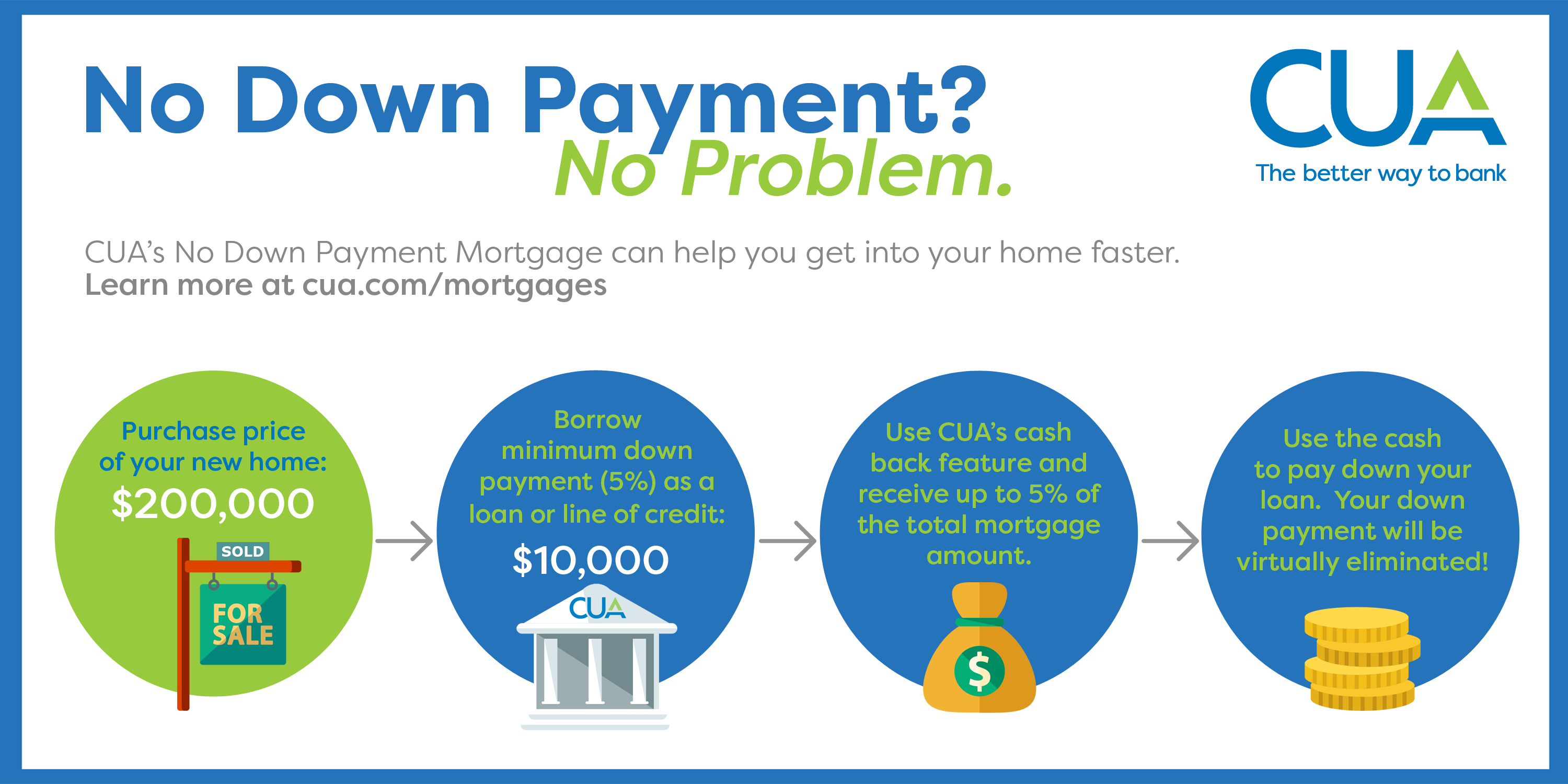

Finding a mortgage with no down payment can be a daunting task, especially if you’re a student. But it’s not impossible! With a little research and some strategic planning, you can find a mortgage with no down payment that works for you. In this article, I’m going to show you how to find a mortgage with no down payment, plus offer some tips and tricks to make the process easier. So, if you’re a student looking for a mortgage with no down payment, this article is for you.

Research no-down-payment lenders

If you’re looking for a mortgage with no down payment, the first step is to research lenders who offer no down payment options. You can look for lenders on the internet, through local organizations, or through government programs. Make sure to read the fine print and ask questions to find the best no-down-payment mortgage for you.

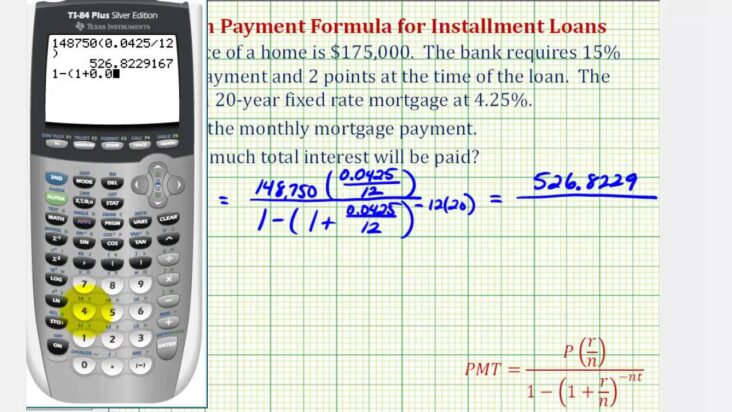

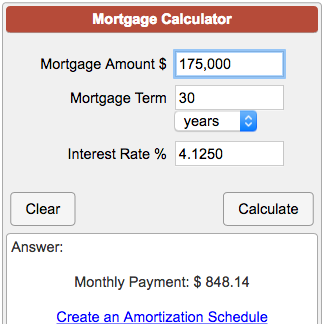

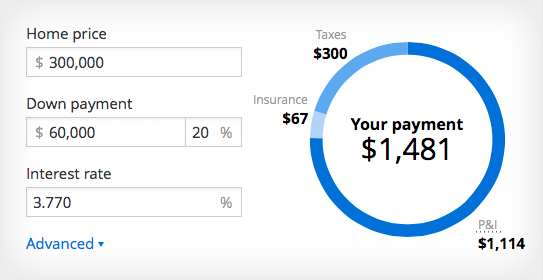

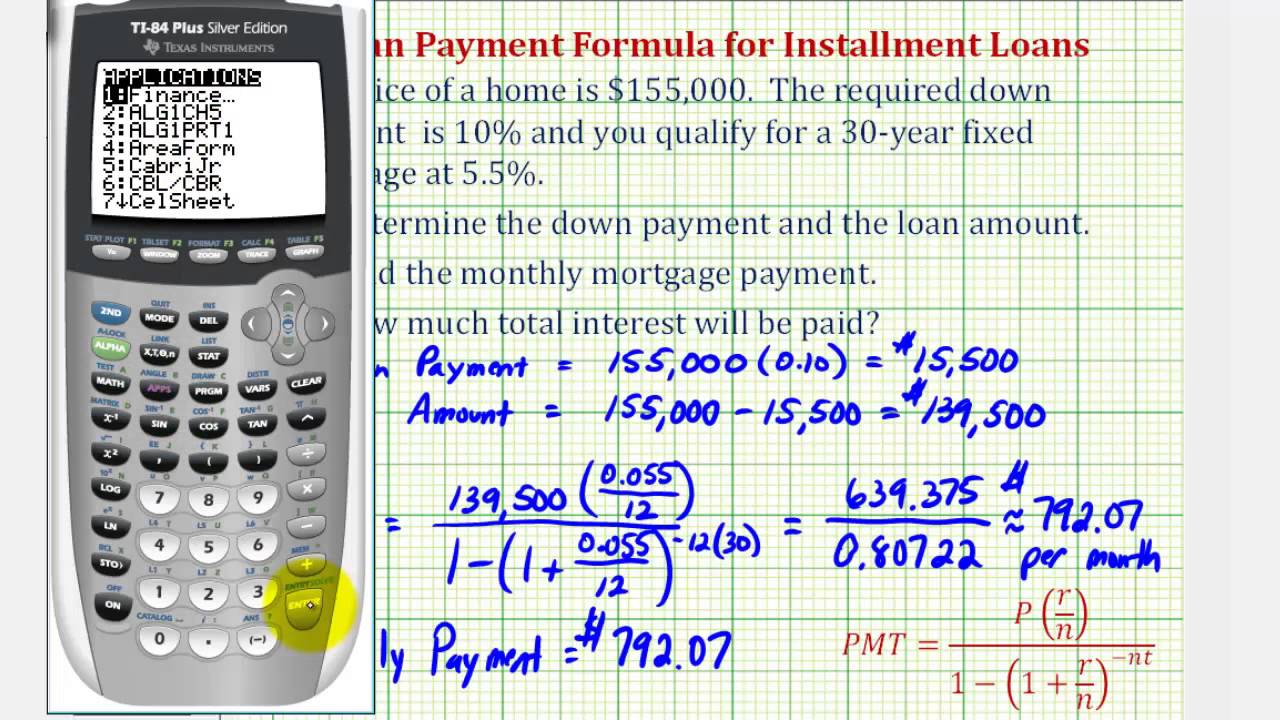

Compare rates/fees

Comparing rates and fees when shopping for a no-down-payment mortgage is the best way to get the best deal. Make sure to look at all the offers and compare the interest rates, fees, and other terms. Don’t be afraid to negotiate with lenders to get the best rate possible. Take your time in order to find the mortgage that fits your budget and needs.

Check credit score

Before you start looking for a mortgage with no down payment, it’s important to check your credit score. A good credit score will help you get better rates and more favorable terms. As an 18-year-old, I suggest getting a free credit report from a reliable source like Experian or TransUnion. It’s an important step in understanding your financial situation and making sure you find the best deal.

Prepare financials

Before applying for a mortgage with no down payment, it is important to have a good understanding of your financial situation. Make sure to have a record of your income and expenses, including any debts you might have. Know your credit score and the amount of money you have saved up. This will make it easier to compare different options and find the best way to get a mortgage with no down payment.

Submit application

Once you’ve found the right mortgage lender, it’s time to submit your application. Make sure you have all the necessary documents and information ready, such as your credit score, employment history, and proof of income. Don’t be afraid to ask questions – the lender should be able to help you every step of the way. Remember, you’re making a long-term commitment, so be sure to shop around and make sure you’re getting the best deal with no down payment.

Get pre-approved!

Getting pre-approved for a mortgage can be a great starting point for finding a mortgage with no down payment. It’s a good idea to get pre-approved before you start looking for a home. This will help you to determine what you can afford and give you an edge when negotiating with sellers. Plus, you’ll have the peace of mind that comes with knowing you have the funds ready to buy when the right property appears.