It’s no secret that buying a home is one of the biggest decisions you’ll make in your life, and it’s important to make sure you don’t make any common mortgage mistakes. Knowing how to avoid these mistakes can save you time, money, and stress. As an 18-year-old student, I’m here to share some of the best tips on how to make sure you don’t fall into any mortgage traps, so you can move into your dream home with confidence.

Research lenders thoroughly.

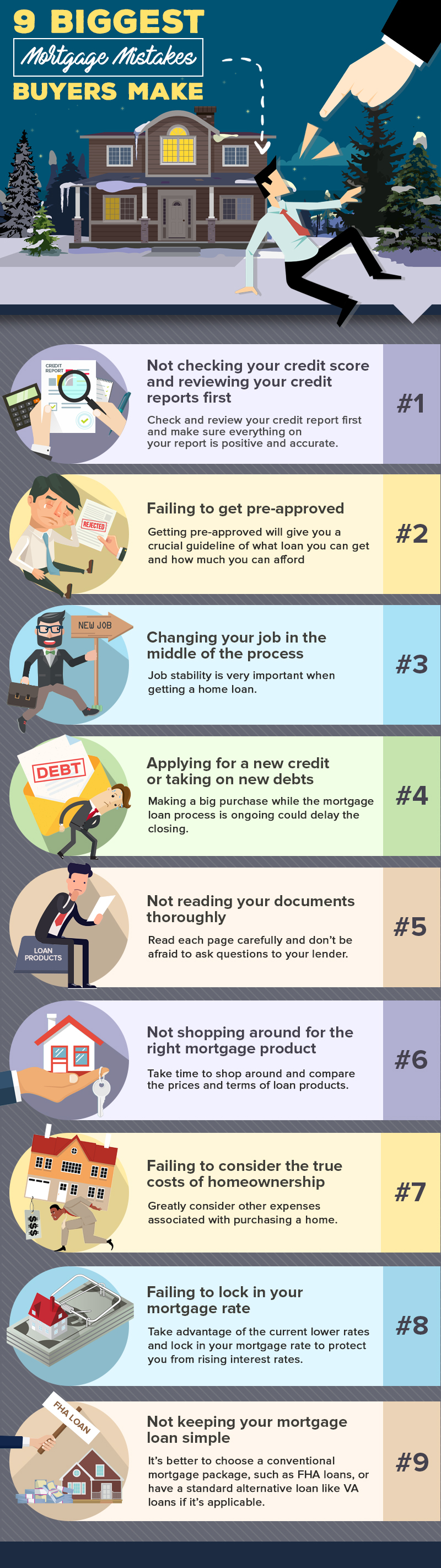

I know that when I was looking for a mortgage, I wanted to make sure I did my research. Taking the time to research different lenders is key to making sure you’re getting the best deal possible. I compared rates, read reviews, and asked friends and family for recommendations. That way, I could make sure I was getting the best rate and avoiding common mortgage mistakes.

Compare mortgage rates.

Comparing mortgage rates is an essential part of the mortgage process. Don’t just settle for the first rate you get since there is a huge range out there to choose from. Take the time to shop around, do some research and compare rates carefully. This way you can find the most suitable mortgage rate for you and save money in the long run!

Calculate affordability.

As a 21-year-old student, one of the main mistakes I made when applying for my first mortgage was failing to accurately calculate my affordability. It’s important to have a realistic budget and understand exactly how much you can afford, as this will help you to negotiate the best deal and avoid any nasty surprises down the line. Make sure to take into account all costs, such as taxes, closing costs and insurance.

Ask questions.

When considering a mortgage, it’s important to ask yourself the right questions. Do I understand the terms and conditions? Am I aware of the fees associated with the loan? Is this the best mortgage rate I can get? Asking questions is key to avoiding common mistakes and getting the best deal on your mortgage.

Read contracts closely.

When it comes to mortgages, make sure to read contracts carefully and don’t just sign them without understanding. Take your time and make sure you understand everything before signing. If there’s something you don’t understand, don’t be afraid to ask questions and seek clarification from your mortgage provider. Don’t be afraid to walk away if something doesn’t feel right. It’s better to be safe than sorry!

Get expert advice.

If you’re a first-time homebuyer, getting expert advice is one of the best ways to avoid common mortgage mistakes. I asked my family’s financial advisor for their opinion and they helped me learn the basics of mortgages and what to look out for. It was helpful to have another perspective and I’m sure you’ll find it helpful too.