Are you a student looking for a way to calculate mortgage payments? Well, you’re in luck! Calculating mortgage payments can seem intimidating at first, but with a few simple steps, you can easily figure out how much your monthly payments will be. In this article, I’ll show you an easy way to calculate your mortgage payments so you can start budgeting for your future home.

Gather loan information.

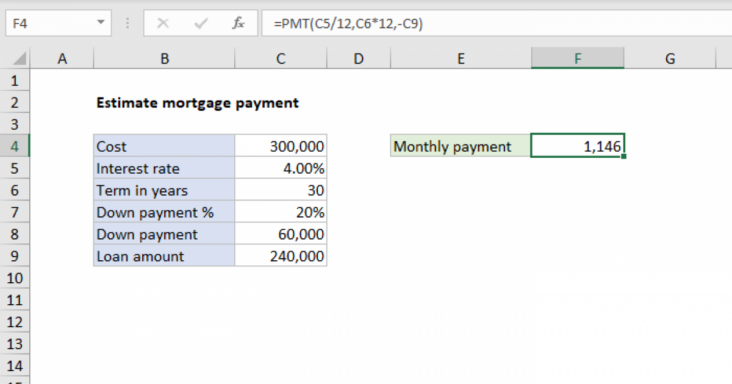

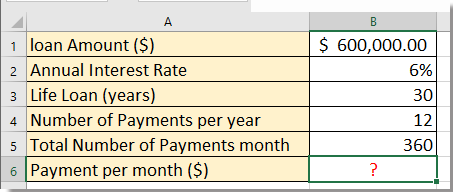

If you’re trying to figure out how to calculate mortgage payments, the first thing you’ll need to do is gather all of your loan information. It’s important to know the total loan amount, the interest rate, and the length of the loan. Make sure you have all the details ready before you start crunching the numbers.

Calculate principal & interest.

Calculating your principal and interest can be a daunting task, but with a few simple steps, you can get a better understanding of your mortgage payments. First, calculate your principal, which is the amount of the loan, minus any down payment. Then, calculate your interest rate, which is the annual rate you pay for borrowing the money. Finally, use an online calculator to get an estimate of your monthly payments. With these calculations, you’ll have a better understanding of your mortgage expenses.

Determine down payment & fees.

Figuring out how much to put down as a down payment and the associated fees can be a bit tricky. But it’s not too hard, and there are online calculators to help you estimate the costs. I’m a college student and I found it helpful to look up some advice on the right size of a down payment and the associated fees. This made it easier to calculate my mortgage payments and budget accordingly.

Calculate total loan amount.

Calculating the total loan amount is an important step when it comes to taking out a mortgage. To do this, you need to look at the loan amount, the interest rate, and the term of the loan. After knowing these three factors, you can use a loan calculator or an amortization table to determine the total loan amount you would need to pay back over the course of the loan. It’s important to consider all of these elements when it comes to deciding on a mortgage.

Divide by loan term length.

Divide the loan amount by the loan term length to calculate the payments you will have to make for your mortgage. For example, if you have a loan of $200,000 and you have a loan term of 30 years, you will have to divide $200,000 by 30 years to determine that your payments will be $6,666.67 per month.

Determine monthly payments.

Figuring out monthly mortgage payments can be daunting, but it’s not as hard as it seems. Start by multiplying the loan amount by the interest rate, then divide that number by 12. That’s your monthly interest rate. Add that number to your principal, and then divide by 12. That’s your monthly payment. Keep in mind that you may have to pay other costs, such as closing costs and insurance.