If you’re looking to get a mortgage but don’t have the full amount of money you need, a partial release mortgage might just be the answer. A partial release mortgage allows you to borrow a portion of the total amount of money you need, while still keeping your existing mortgage. With this type of loan, you can enjoy the benefits of a lower interest rate and more flexible terms. In this article, we’ll explore the process of getting a partial release mortgage to help you decide if it’s the right option for you.

Research lenders/rates.

Researching potential lenders and rates is a crucial step in the process of getting a partial release mortgage. It’s important to compare different lenders and rates to make sure you’re getting the best deal.

Calculate budget/affordability.

Calculating your budget and affordability for a partial release mortgage is an important step to take before applying for one. It helps to ensure that you have a realistic understanding of the costs associated with the loan, as well as what you can afford to pay. To calculate your budget, you’ll need to consider your income, debts, and other expenses. Additionally, make sure to factor in the extra costs associated with a partial release mortgage, such as the costs of refinancing.

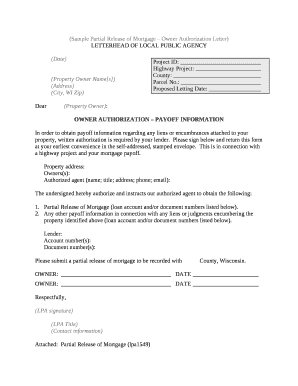

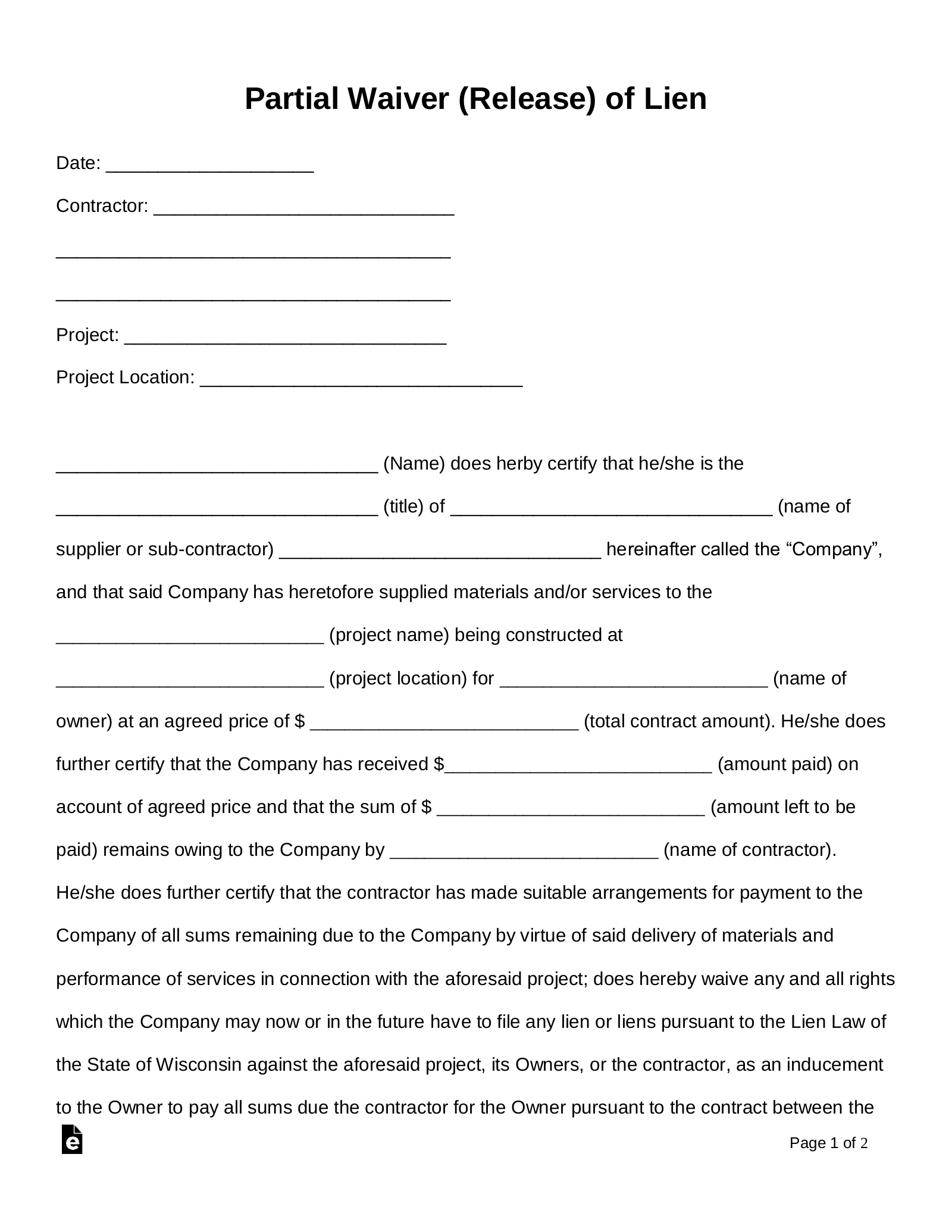

Gather documents/proofs.

Gathering documents and proof of your finances is an important step in obtaining a partial release mortgage. To be approved, you will need to provide bank statements, pay stubs, tax returns, and other documents that prove your income and assets. Additionally, you will need to present proof of a good credit score, which is usually determined by a credit report.

Apply for loan.

When applying for a partial release mortgage, be sure to have all the necessary documents needed to make the process as easy as possible. This includes proof of income, bank statements, credit history, and other relevant documents.

Submit down payment.

Submitting a down payment is one of the most important steps when applying for a partial release mortgage. This payment is usually a percentage of the total loan amount and is usually required up front. It is important to have the funds available prior to applying for the loan to ensure a successful application.

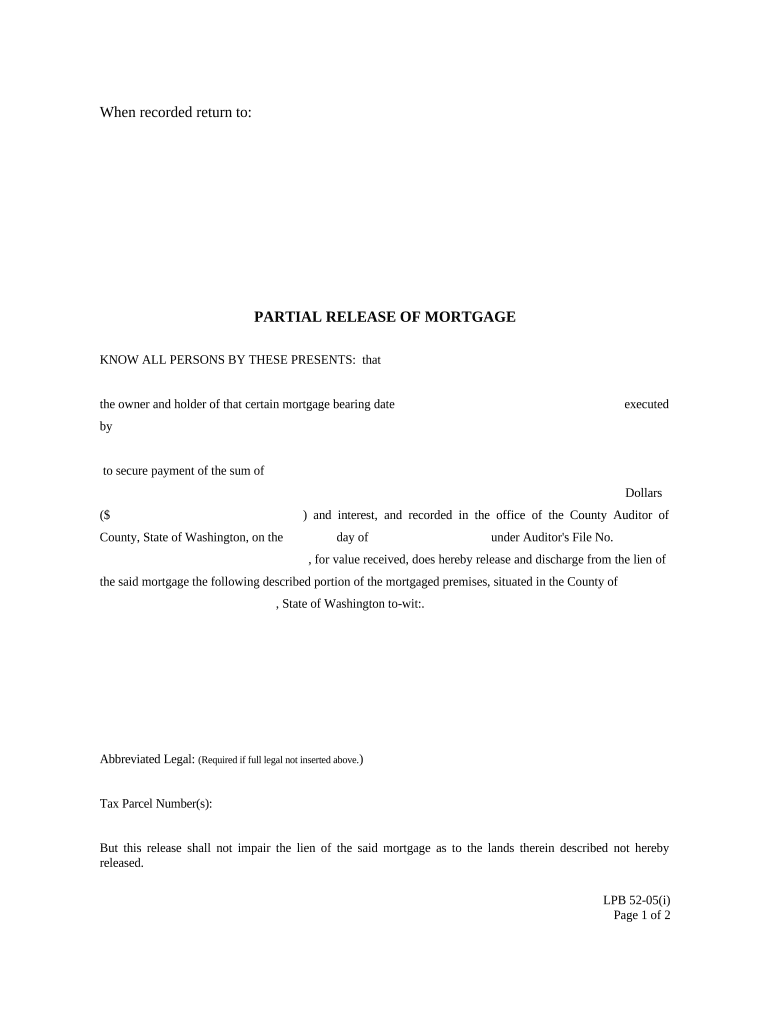

Sign mortgage agreement.

Once you’ve agreed on the loan terms, the next step is to sign the mortgage agreement. This document outlines the specifics of the loan, such as the length of the loan and the interest rate, so be sure to read it carefully before signing.