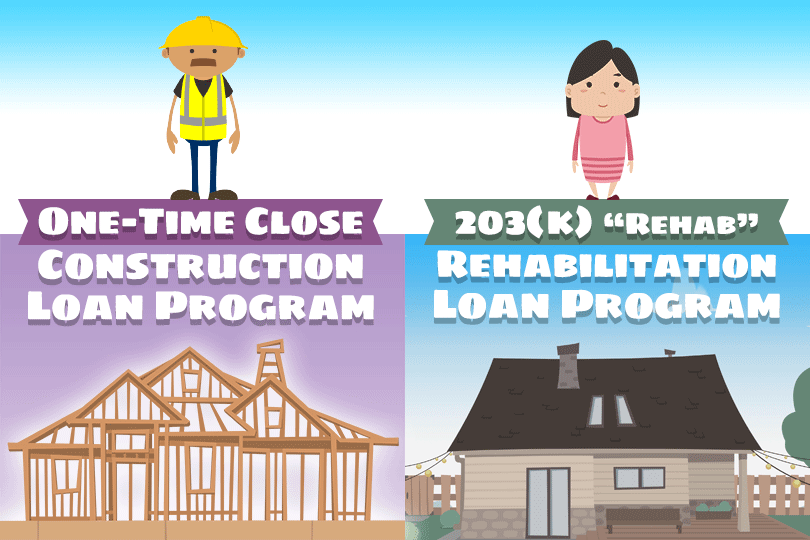

Are you looking for a way to finance a property that needs some work? Rehabilitation mortgages are a great solution for those looking to buy and renovate a property. They are designed to help you purchase and renovate a home in a single transaction, making the process easier and more cost-effective than taking out separate loans for each task. In this article, we’ll explain what a rehabilitation mortgage is, the different types available, and provide some tips for getting one. Read on for more information about how to get a rehabilitation mortgage.

Research rehab mortgages

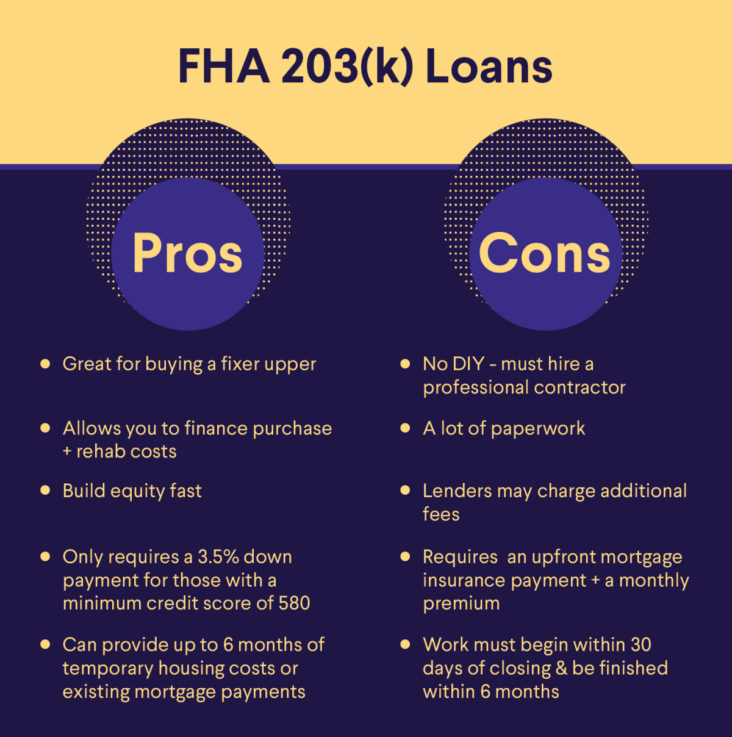

Researching rehab mortgages can be an intimidating task, but it doesn’t have to be. With a bit of research and knowledge, finding the right loan for your project can be easy.

Find local lenders

When looking for local lenders for a rehabilitation mortgage, reach out to your local banking and financial institutions. They are likely to have the most up to date information and resources to make sure you get the best deal.

Prepare financials

Preparing financials for a rehabilitation mortgage is a crucial step in the process. It’s important to review all financial documents, such as credit reports, tax returns, and bank statements, to ensure accuracy and provide a comprehensive overview of your financial standing. Additionally, a budget should be created to plan for any additional expenses associated with the rehabilitation project.

Apply for loan

Applying for a rehabilitation mortgage loan can be a daunting task for many. However, it’s important to know what the process involves so you can make the most of your loan. Start by gathering all the necessary documents, such as income and credit reports, then contact lenders to compare rates and loan amounts. Be sure to ask questions to ensure you’re getting the best deal for your needs.

Submit documents

Submitting documents for a rehabilitation mortgage is a crucial step in the process. All relevant documents need to be submitted in order to be considered for a loan application. This includes proof of income, employment, credit score, and other financial documents. It is important to ensure the documents are accurate and up-to-date in order to get the best possible loan approval.

Receive loan funds

Once you have been approved for a rehabilitation loan, you will receive the loan funds and be ready to start your project. Make sure to use the money as intended, so you can get the most out of your loan.